There are no stories that match your filters.

Mollie enters the Czech payments market, offers Czech localization and support

Mollie expands into Central Europe expands to support local businesses as the company reduces financial bureaucracy across Europe.

Mollie launches Tap: its smart payment terminal for seamless in-person payments

Mollie Tap: Smart, fast, affordable terminal for seamless in-person payments. Unify online & offline sales. Easy, affordable, ready in 30 secs.

Mollie and Peakz Padel join forces to drive impact on and off the court

Mollie & Peakz Padel reveal Mollie Dome

Mollie grows by 30% in 2024

2024 Financial Results

Mollie launches payment solutions in Portugal for the growing ecommerce market

Lisbon tech hub expands to support local businesses as Mollie reduces financial bureaucracy across Europe.

Qonto & Mollie announce two-way collaboration to empower European businesses

Qonto integrates Mollie’s embedded payments solution to enable its customers to easily accept payments online.

Mollie expands into Sweden

Mollie chooses Sweden for Nordic expansion.

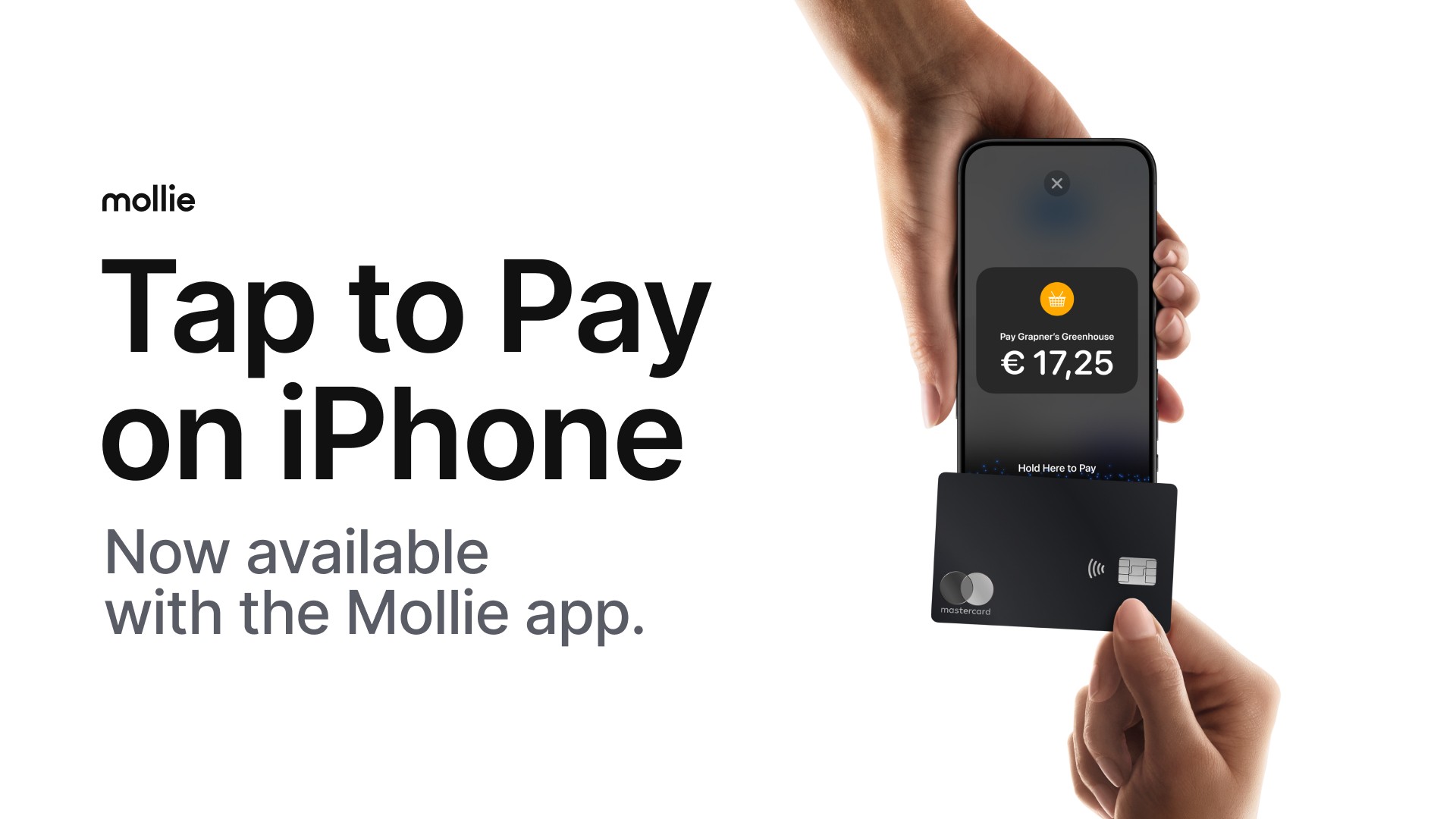

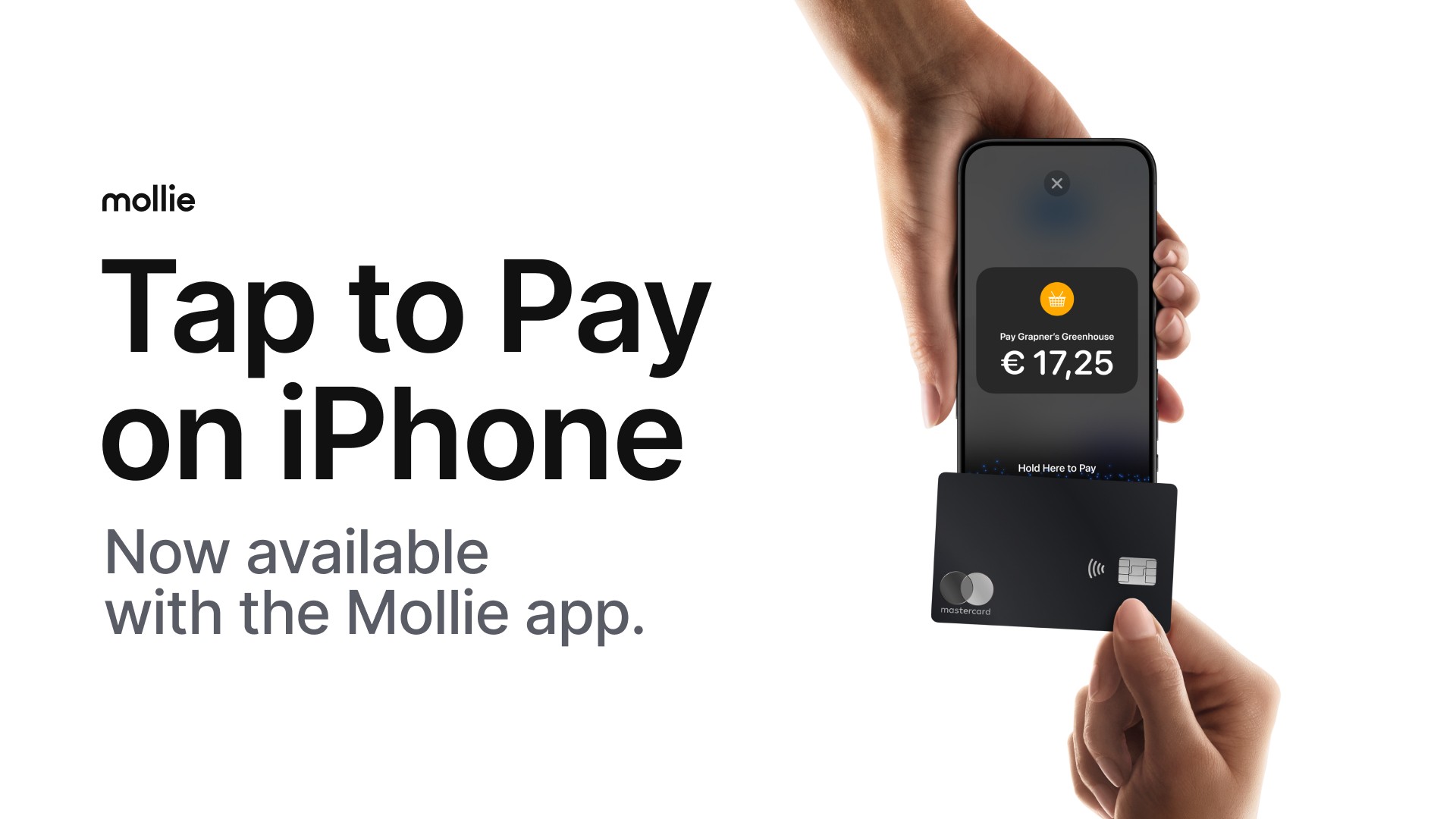

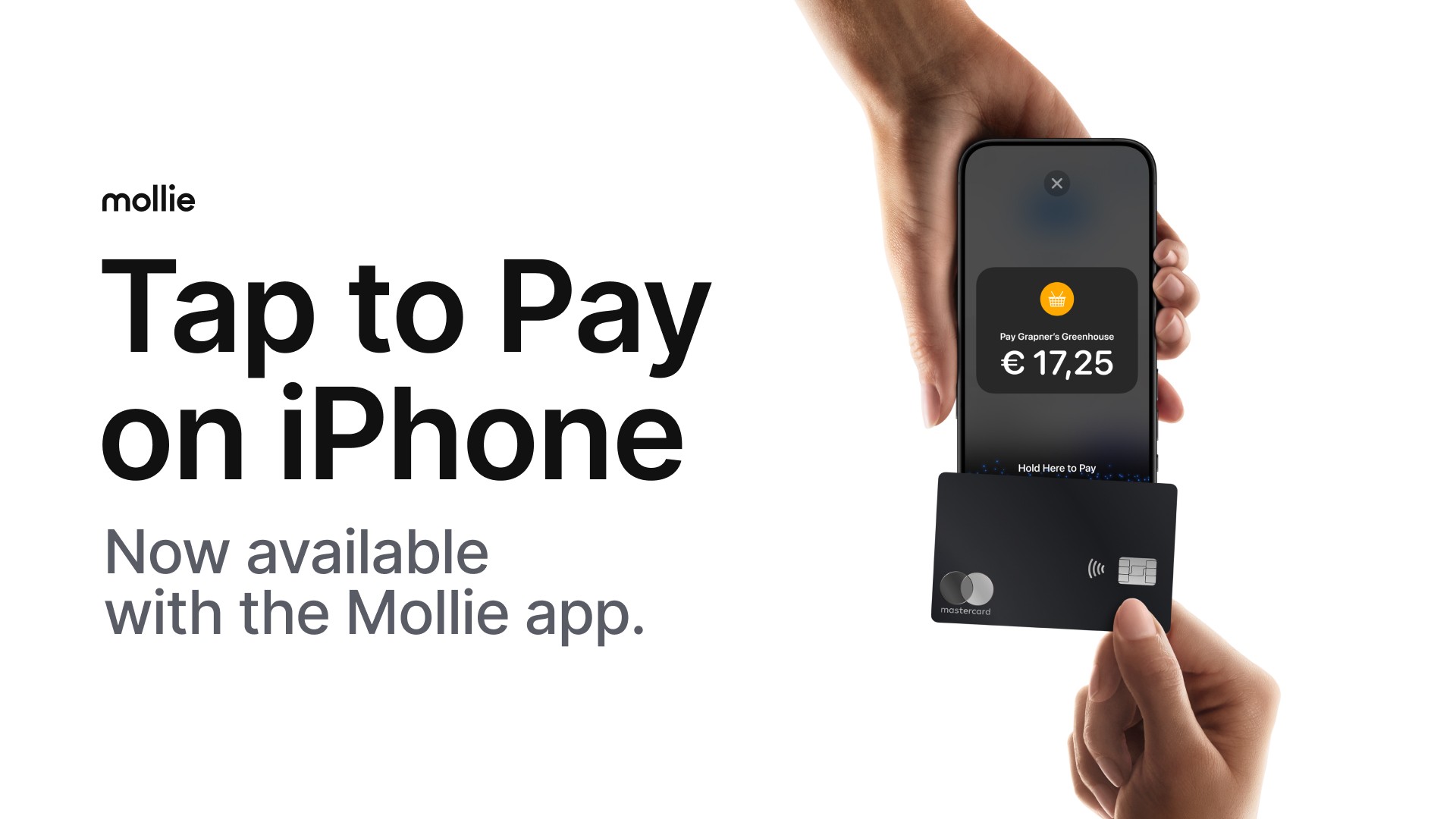

Mollie enables Tap to Pay on iPhone in Austria, Italy and the United Kingdom

Mollie customers in Austria, Italy and UK can now use their iPhone and the Mollie iOS app to accept contactless payments without the need to purchase or manage additional hardware

Mollie and Alma join forces to offer a new growth driver for merchants

Mollie is delighted to announce its partnership with Alma to provide payment solutions in 3 or 4 instalments in France and Belgium.

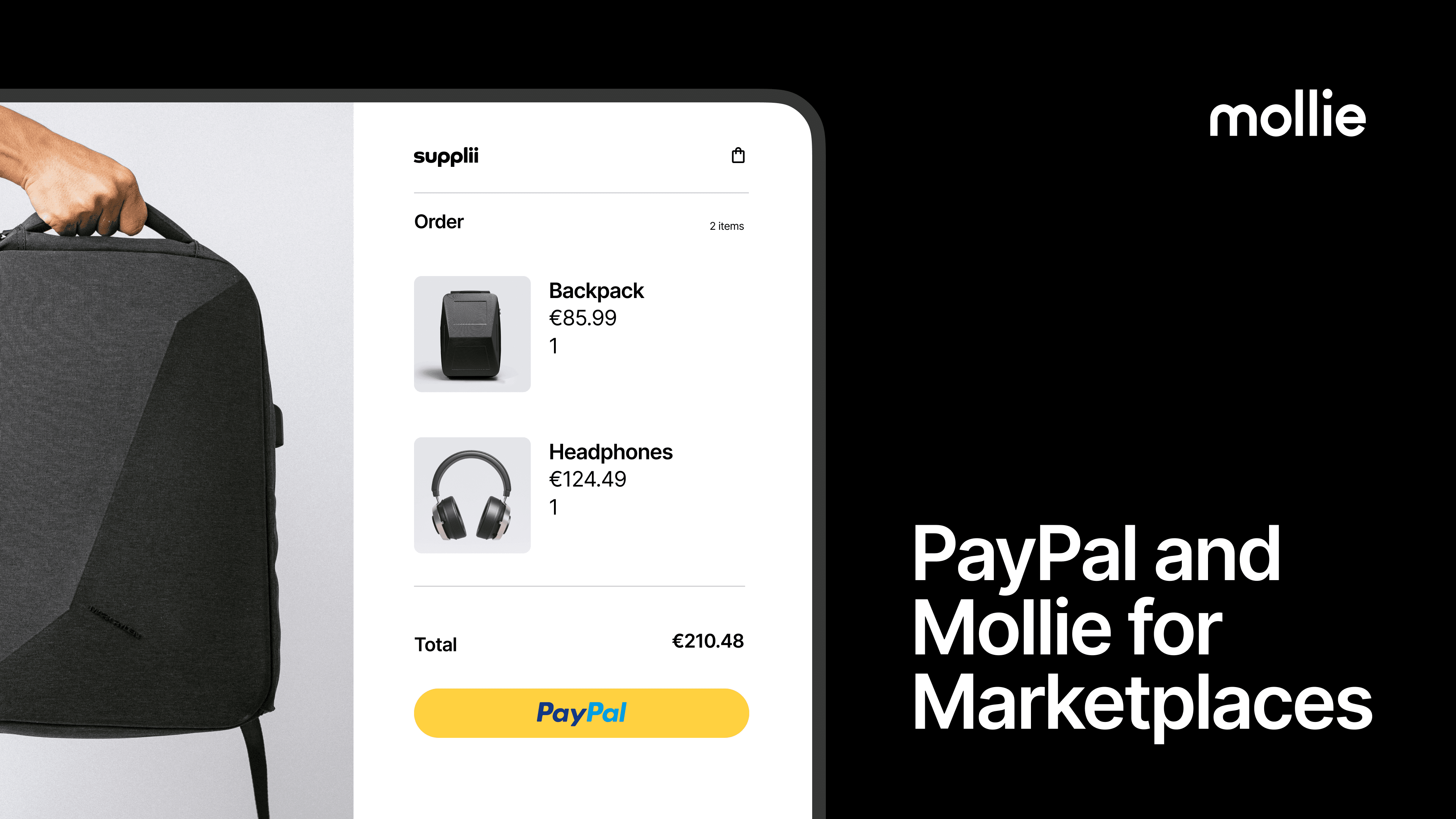

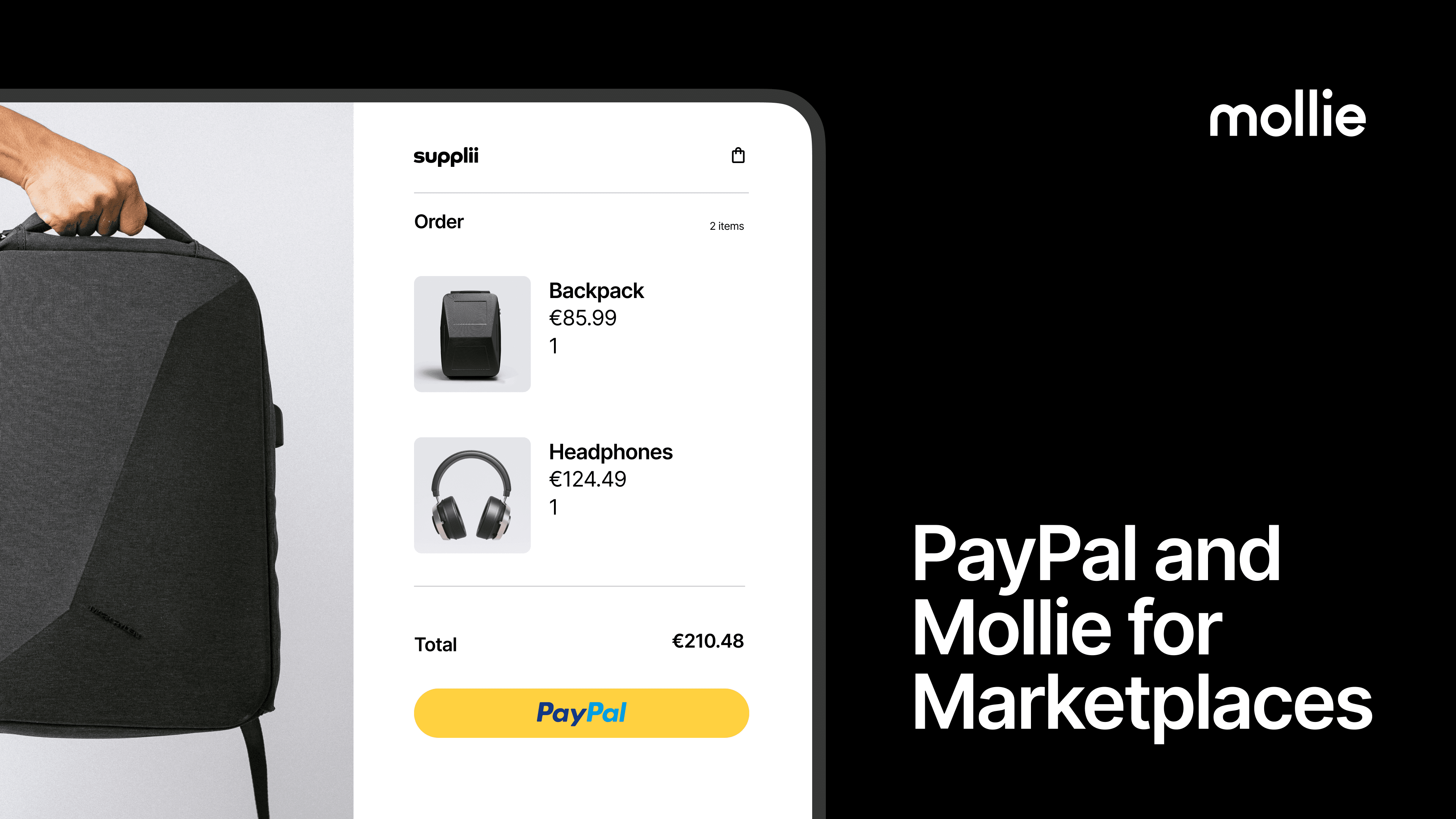

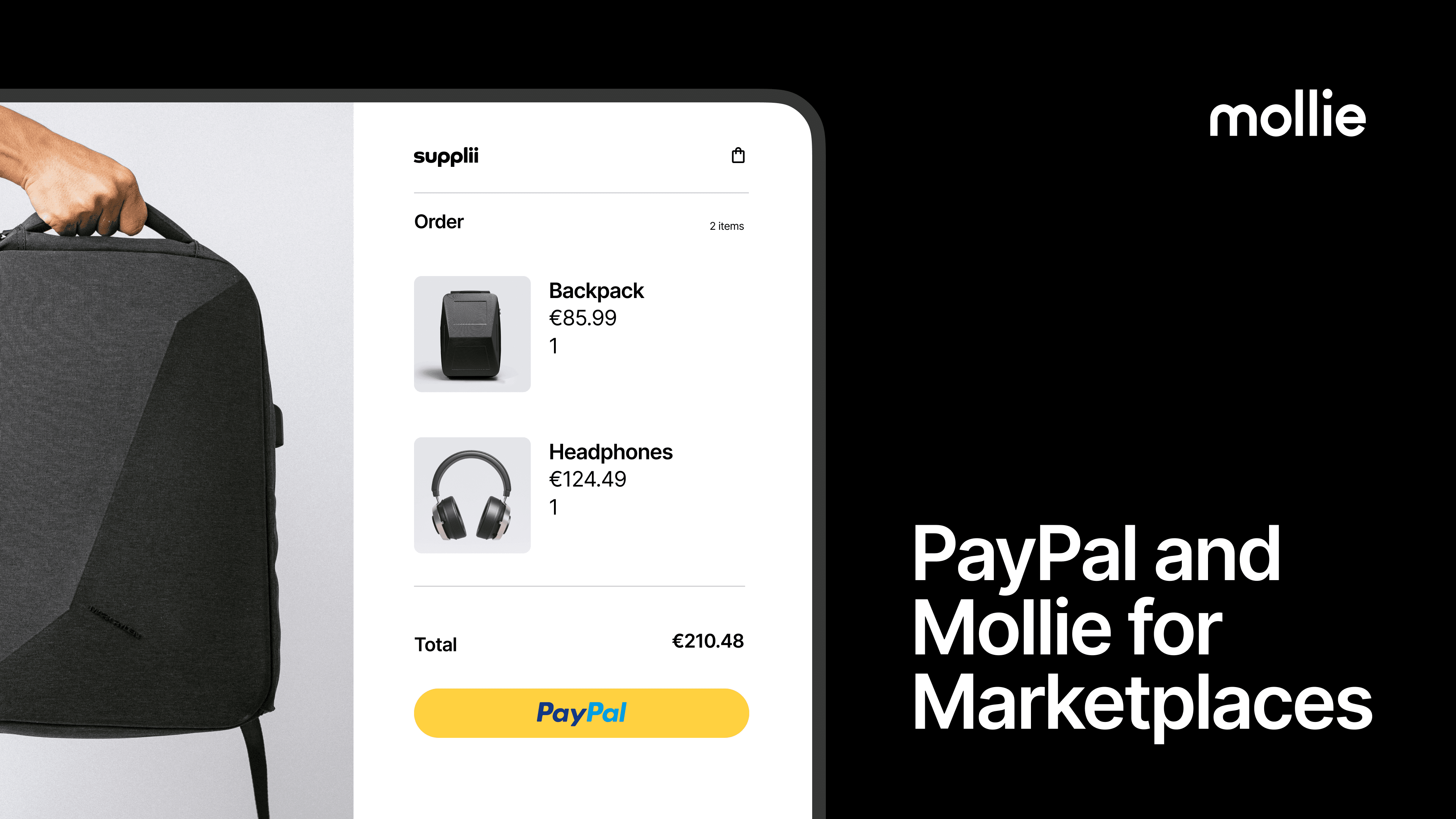

Mollie and PayPal join forces to enhance marketplace payments in Europe

Mollie is excited to announce a strategic partnership with PayPal, aimed at delivering secure and easy payment solutions for marketplace platforms across Europe.

Mollie expands into Italy with local payment solutions for businesses

Mollie announces its official launch in Italy, marking a significant milestone in its mission to make payments and money management effortless for every business in Europe.

Mollie enables Tap to Pay on iPhone in The Netherlands, France and Germany

Mollie customers can now use their iPhone and the Mollie iOS app to accept contactless payments without the need to purchase or manage additional hardware

Are you the next Mollie Ecommerce Manager of the Year?

Enroll yourself or your top candidate now for the Shopping Award: Mollie Ecommerce Manager of the Year!

Mollie and Hyvä announce strategic partnership, launching Hyvä Commerce

Mollie and Hyvä, a pioneer in front-end development for ecommerce, are excited to announce a strategic partnership, launching Hyvä Commerce.

Mollie announces integration with HubSpot to streamline CRM payments

Mollie announces its integration with HubSpot, which will enable businesses to initiate and track payments directly from HubSpot in seconds.

Mollie achieves triple-digit UK growth and welcomes new UK managing director

Fintech veteran Dave Smallwood’s addition and the expansion of Mollie’s UK team strengthens its market position, helping UK SMBs eliminate financial bureaucracy.

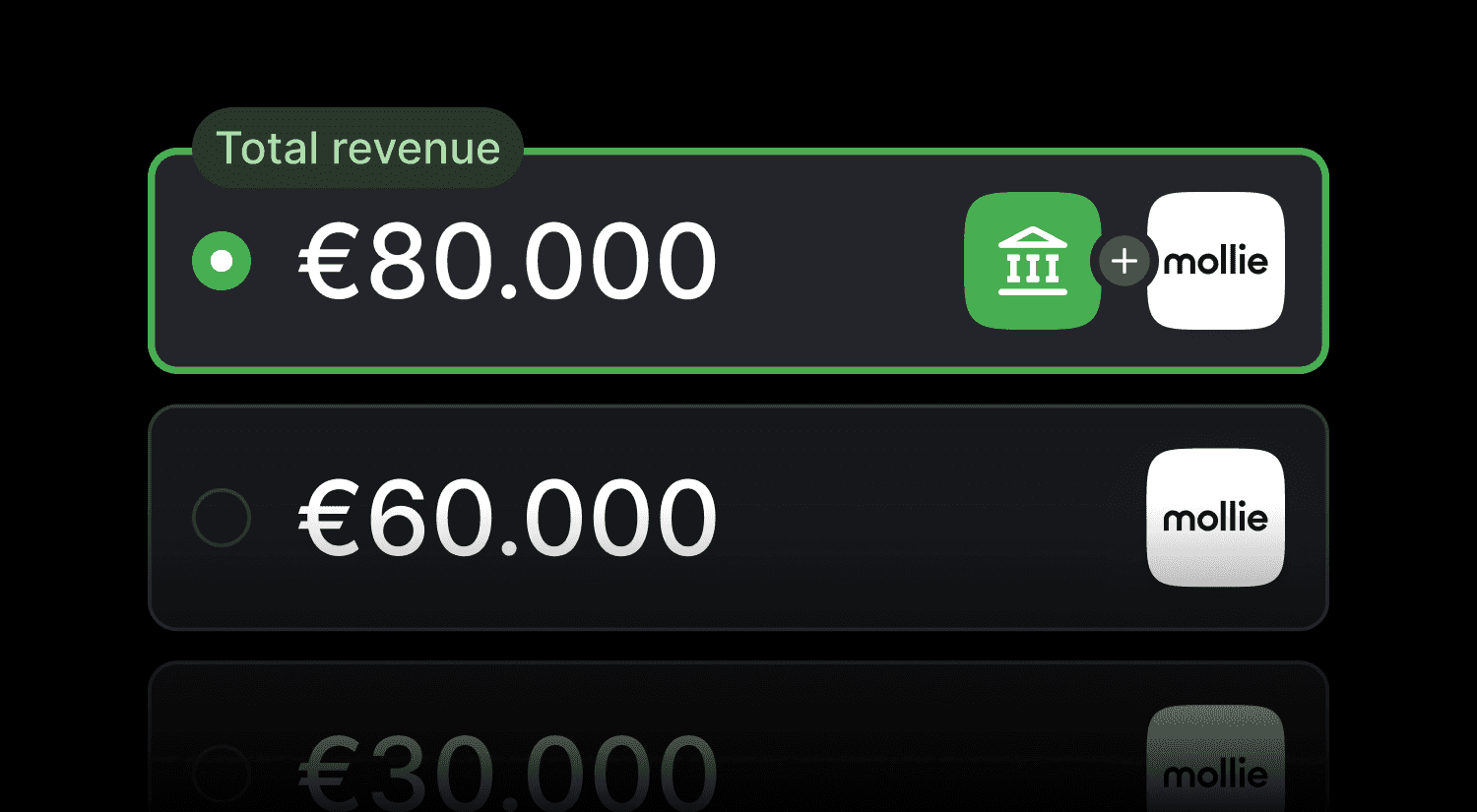

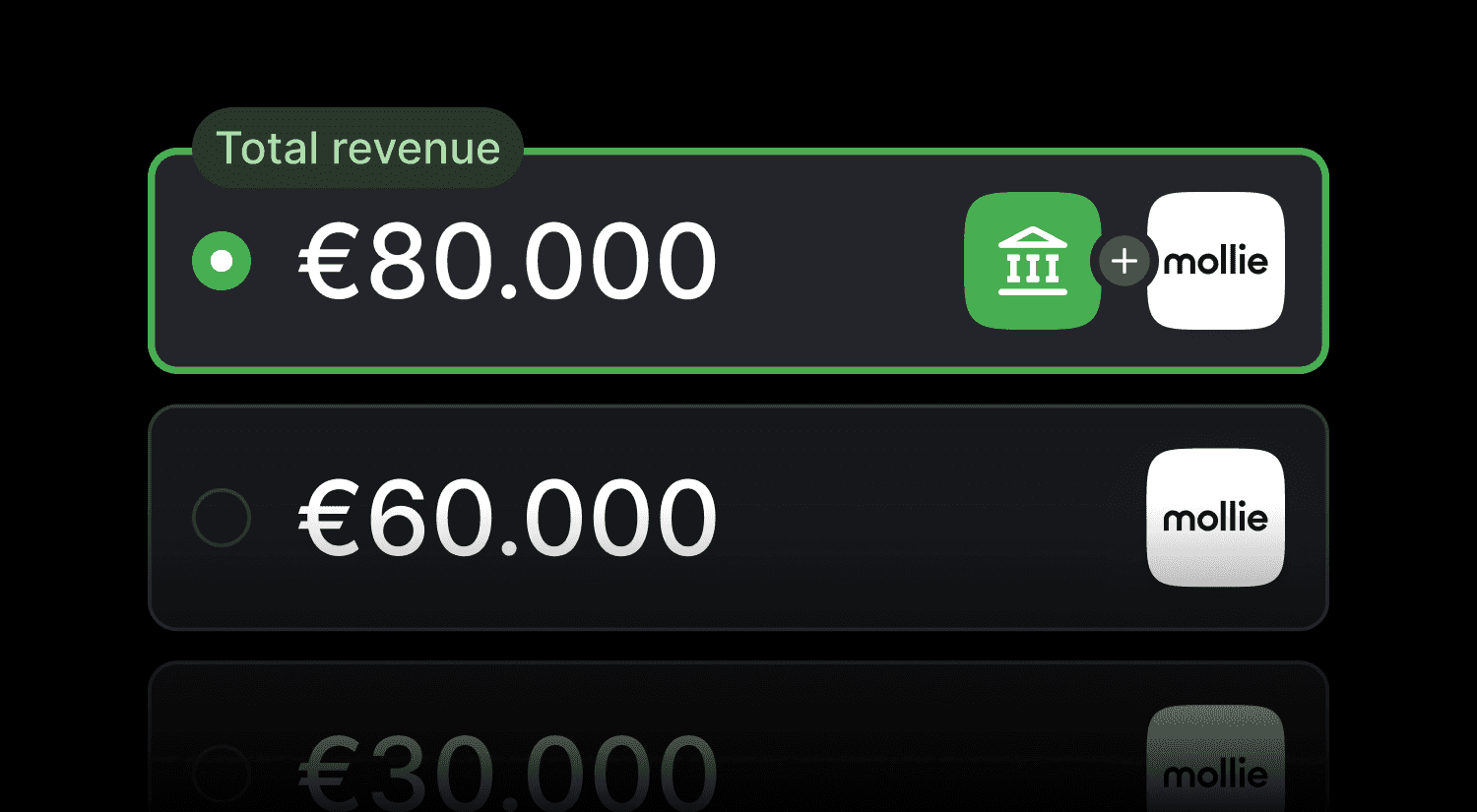

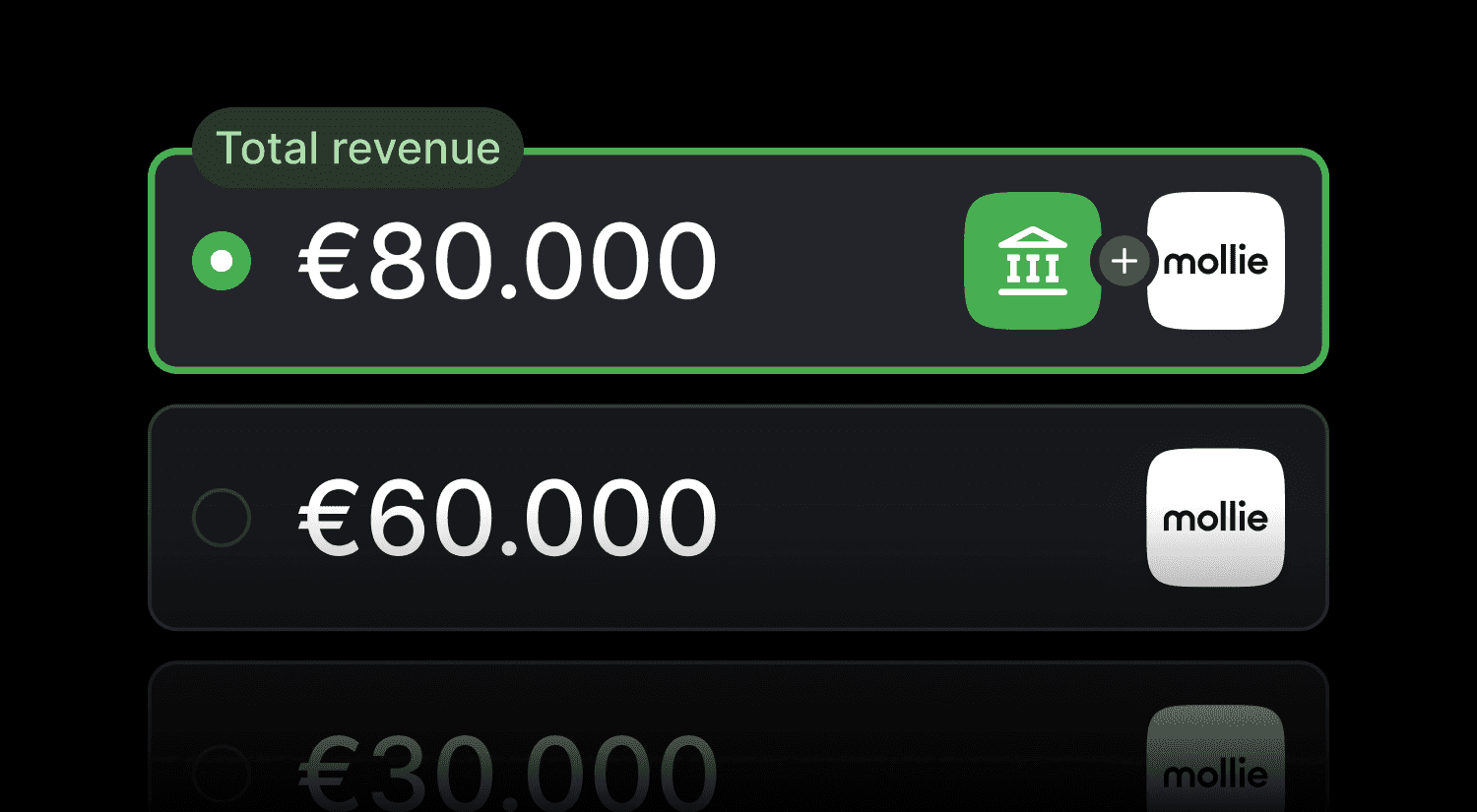

Secure more funding with Mollie Total Revenue

Access higher funding offers by including all revenue streams through Open Banking with Mollie Total Revenue. Discover how much funding you can get.

Mollie and JTL: strategic partnership for seamless e-commerce payments

JTL-Software GmbH (JTL), a leading German e-commerce solution provider, and the Dutch financial services provider Mollie are entering into a strategic partnership.

Mollie and Riverty join forces offering 30 day invoicing solution

Mollie customers can now offer end users an additional option to pay afterwards, with a payment period of up to 30 days.

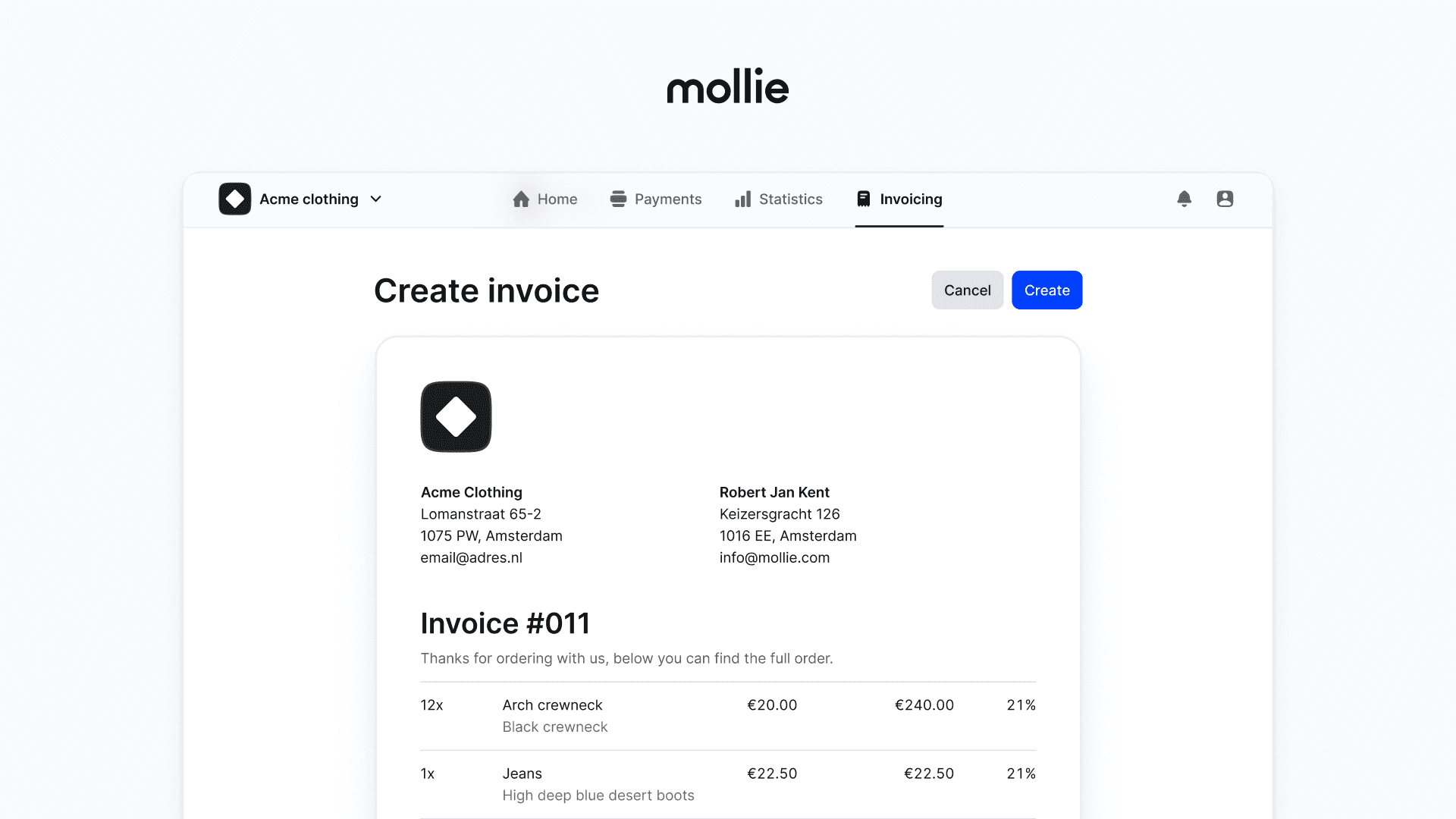

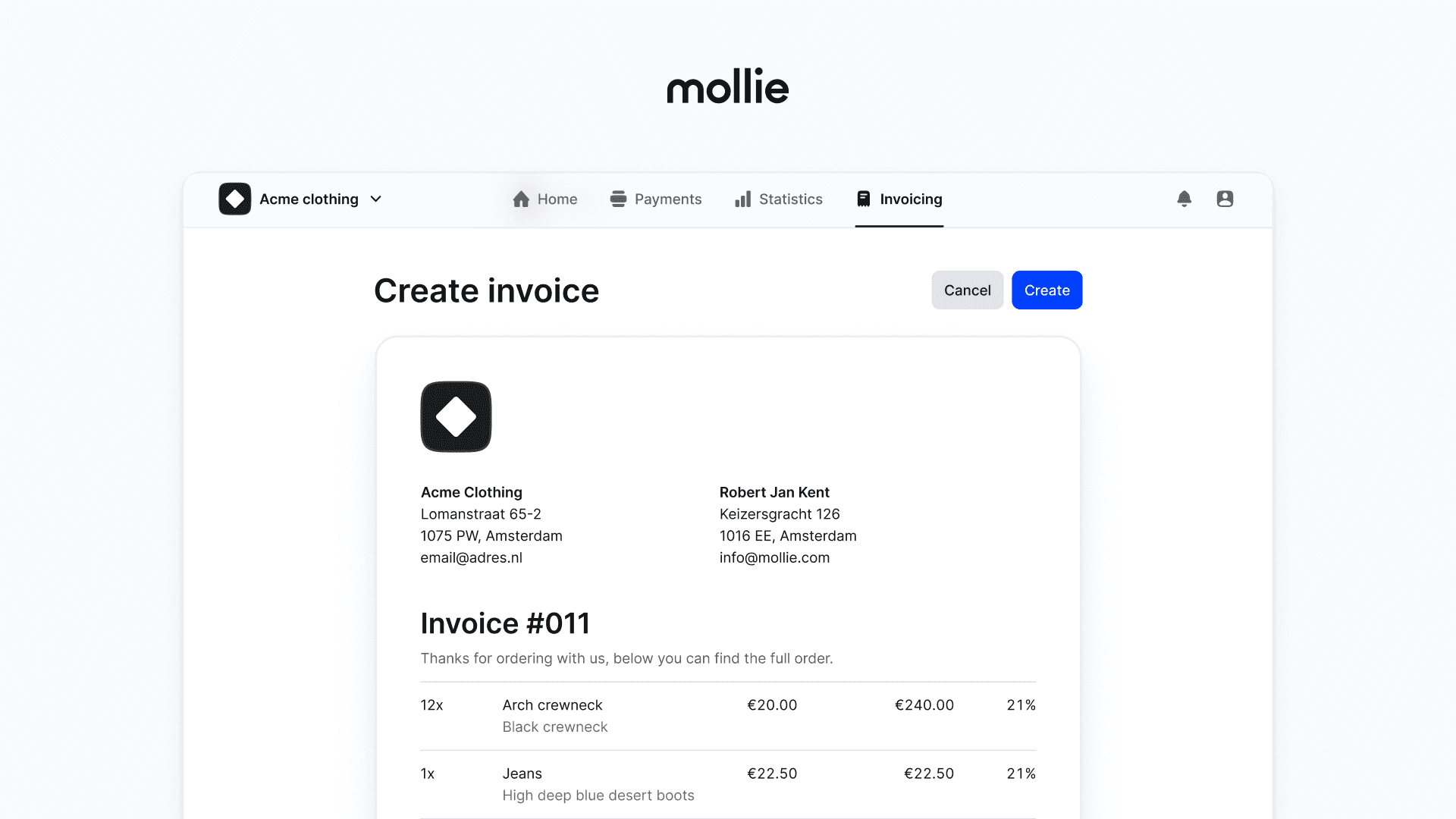

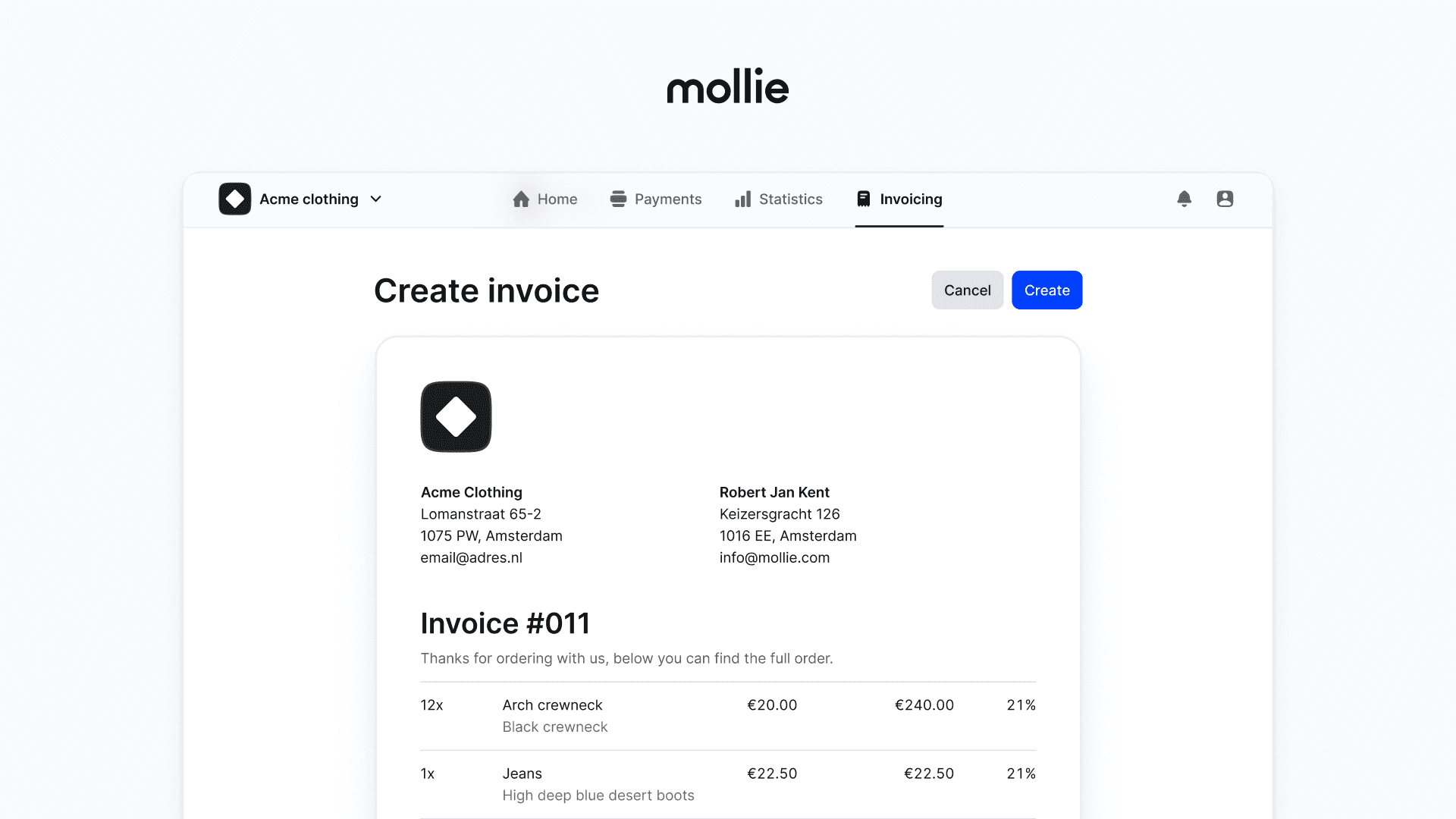

Mollie Launches Invoicing Solution: Mollie Invoicing

Introducing Mollie Invoicing – our new refreshingly simple revenue collection tool. It’s a new way to create, edit, and send invoices. All from your Mollie Dashboard.

Mollie’s net revenue grew 36% in 2023

Annual results show how customer-first strategy is yielding strong returns for one of Europe’s fastest growing financial service providers.

Mollie expands through partnership with Edenred

Mollie announces a strategic partnership with Edenred to integrate diverse payment solutions, boosting merchant capabilities and enhancing customer convenience in e-commerce.

Mollie Capital launches in the UK to help firms with fast, flexible financing

Mollie Capital – a fast and flexible way for businesses to access funding – is now available in the UK.

Visit Mollie at Webwinkel Vakdagen 2024

The time has almost come: the 17th edition of the Webwinkel Vakdagen will take place on 23 and 24 March. Come and visit us at stand 33.

Mollie named an Adobe Gold Technology Partner

Mollie has been named as an Adobe Gold Technology Partner. Find out how we help Adobe Commerce businesses offer reliable, secure payments.

Biggest Black Friday week ever – with sales up 7.3% compared with 2022

Mollie data reveals record Black Friday week online spending with European consumers checking out larger basket sizes

Holiday season wins with American Express via Mollie

Not only is the holiday season is one of the most important sales events of the year for online businesses and ecommerce brands - it also attracts high-spending, loyal customers.

Mollie is now offering TWINT

Experience enhanced payment flexibility as Mollie integrates TWINT, offering seamless transactions for businesses and customers.

Mollie introduces new Supervisory & Management Board appointees

Welcoming Sarah Roberto as our new Chief Risk and Compliance Officer, Vincent Toolan as our Chief Financial Officer, and Leni Boeren to our esteemed Supervisory Board.

Mollie transitions from EU to UK Payment Institution license

Mollie takes major step in solidifying its position in the payment market of the United Kingdom.

Shopware awards Mollie Platinum Partner status

Shopware has awarded Mollie Platinum Partner status. Discover how we help Shopware customers offer the best online payment experience.

Mollie integrates with Klaviyo enabling personalised marketing automation

Tech leaders join forces to release a new and seamless integration

Magento 1 ecommerce websites and PCI compliancy

Guest post by UK agency partner Absolute Design discussing Magento 1 and PCI compliancy

The Mollie Terminal: in-person payments designed for our customers

We sat down with Mollie CEO/CTO Koen Köppen to discuss the Mollie Terminal and our move into unified commerce.

Mollie launches Terminal, strengthening its in-person payments proposition

Mollie Terminal integrates in-person and online payments for unified commerce

Mollie and Billie launch pan-European partnership

Mollie strengthens B2B product offering through Buy Now‚ Pay Later partnership with Billie.

Mollie announces change in company leadership

Former Klarna CTO Koen Köppen will drive innovation and product focus.

Shieldpay partners with financial services provider Mollie

The partnership will enable Shieldpay clients to have their payments needs fully digitised.

Mollie data reveals strong Black Friday & Cyber Week Preview

Small and medium-sized ecommerce merchants defy pessimism with strong sales increases across the peak shopping period.

5 Lessons from Megekko CEO Adri Broos to Make Better Choices as an Entrepreneur

You can learn from others' choices. Get inspired by Adri Broos' 5 lessons to make better decisions as an entrepreneur.

Mollie launches Mollie Capital to offer customers flexible financing

Mollie Capital helps businesses access fast and flexible funding to drive growth.

Mollie partners with Vonage for Jumper.ai’s European payments

We're partnering with global cloud communications leader Vonage as the strategic payment provider for their new end-to-end conversational commerce solution Jumper.ai.

Mollie named as EMEA 60 Leader by payments platform PYMNTS

The accolade recognises a company's valuation and influence among European fintech companies.

Mollie launches Technology Partner Program

Our new Technology Partner program is designed to drive growth for our SaaS and tech partners.

Mollie launches ecommerce integration with ePages

We're partnering with ePages to offer effortless payments to even more European ecommerce businesses.

Mollie and Xentral join forces to smoothen ecommerce payments and ERP processes

Mollie and Xentral now offer an integrated solution. The combined tech stack of ERP and PSP is a significant growth driver for e-commerce companies.

Mollie and Sendcloud join forces to simplify paid returns

Sendcloud and Mollie's Paid Returns allows businesses to charge customers for their return shipment automatically.

Mollie partners with Plaid to improve customer experience

Plaid's solutions will help Mollie customers access seamless onboarding and quicker bank account verification.

Koen Köppen named new Mollie CTO

Former Klarna executive Koen Köppen joins as we expand into financial services.

Philippe Daly appointed Vice President of Mollie France

Mollie is accelerating its growth in France with the appointment of Philippe Daly as Vice President.

Mollie launches in3 buy now pay later payments

Mollie customers operating in the Netherlands can now offer in3 as a payment method.

Mollie named a BigCommerce preferred technology partner

Discover more about how our flexible online payments are driving growth for BigCommerce customers.

Mollie teams up with Recharge to offer best-in-class subscription solution

Our new subscription management and recurring payments integration is here.

Mollie Payments for WooCommerce arrives in the UK

Discover how our long-term partnership with WooCommerce is accelerating growth for businesses throughout Europe.

Mollie powers Mazda with simplified payments

Discover how Mollie Connect for Platforms is powering payments for Mazda's new marketplace platform

Mollie launches Connect for Platforms

An effortless payment solution built for platform businesses to quickly integrate‚ accept and scale their online payments.

Mollie appoints ex-PayPal Annett Polaszewski-Plath as managing director DACH

Polaszewski-Plath is responsible for the payment service provider's growth in Germany‚ Austria‚ and Switzerland.

Mollie and Chargebee: effortless subscriptions and payments

Mollie and Chargebee have teamed up to offer a subscription management and billing tool that offers exceptional payments‚ service and support.

Mollie’s mission: why we want to be the world's most-loved PSP

Our mission is to simplify financial services so that all businesses can grow. For us‚ it's more than just words; it's the fuel driving everything that we do.

Mollie announces fintech Centre of Excellence in Maastricht Netherlands

New site to boost Maastricht economy‚ targeting over 200 hires across operations‚ software engineering‚ product design legal‚ compliance‚ commercial and HR in the next 3-5 years.

Customer Stories: Praxisdienst

"Mollie is much more reliable and faster in change management‚” — Michael Heine CEO at Praxisdienst.

Mollie raises 800 million USD in Blackstone Growth–led Series C funding round

The investment will help accelerate Mollie's scaling‚ global expansion and technology development.

Rogier Schoute has been appointed as Mollie’s Chief Product Officer

Introducing Mollie's new Chief Product Officer Rogier Schoute

Shane Happach has been appointed as Mollie’s new CEO

We are pleased to announce that Shane Happach has been appointed as Mollie's new CEO.

Mollie: A Secure Intermediary Between Your Bank Account and an Online Store

Explore Mollie's secure online transactions, ensuring your payment safety with webshops.

Mollie raises 90 million Euro in TCV-led Series B funding

Brings total raised to 115 million Euro‚ will help drive Mollie's international expansion and new product development.

Invoices Settled Swifter with Payment Links

Boost invoice payments effortlessly with secure payment links. Quick, easy, and adaptable, enhancing customer payment convenience.

Mollie and Shopify: Growing together in Europe

We've just extended our partnership with Shopify! Now‚ merchants throughout the whole of Europe can use all our major payment methods in an easy integration.

Mollie raises €25 million in first-ever funding round

Fundraising from long-term strategic investors to support the company's rapid expansion and simplify the lives of online small and medium-sized businesses across Europe.

Mollie launches collaboration with online accounting platform Yuki

Keeping track of your accounting has just become even easier‚ thanks to the integration of Yuki and Mollie.

Mollie introduces plugin for OXID

The payment service provider Mollie has released its latest plugin for OXID eShop.

Plugin update: Recurring payments with Mollie and WooCommerce Subscriptions

Enhance your WooCommerce store with Mollie's plugin update, now supporting hassle-free recurring payments for subscriptions and more.

Mollie enters the Czech payments market, offers Czech localization and support

Mollie expands into Central Europe expands to support local businesses as the company reduces financial bureaucracy across Europe.

Mollie launches Tap: its smart payment terminal for seamless in-person payments

Mollie Tap: Smart, fast, affordable terminal for seamless in-person payments. Unify online & offline sales. Easy, affordable, ready in 30 secs.

Mollie and Peakz Padel join forces to drive impact on and off the court

Mollie & Peakz Padel reveal Mollie Dome

Mollie grows by 30% in 2024

2024 Financial Results

Mollie launches payment solutions in Portugal for the growing ecommerce market

Lisbon tech hub expands to support local businesses as Mollie reduces financial bureaucracy across Europe.

Qonto & Mollie announce two-way collaboration to empower European businesses

Qonto integrates Mollie’s embedded payments solution to enable its customers to easily accept payments online.

Mollie expands into Sweden

Mollie chooses Sweden for Nordic expansion.

Mollie enables Tap to Pay on iPhone in Austria, Italy and the United Kingdom

Mollie customers in Austria, Italy and UK can now use their iPhone and the Mollie iOS app to accept contactless payments without the need to purchase or manage additional hardware

Mollie and Alma join forces to offer a new growth driver for merchants

Mollie is delighted to announce its partnership with Alma to provide payment solutions in 3 or 4 instalments in France and Belgium.

Mollie and PayPal join forces to enhance marketplace payments in Europe

Mollie is excited to announce a strategic partnership with PayPal, aimed at delivering secure and easy payment solutions for marketplace platforms across Europe.

Mollie expands into Italy with local payment solutions for businesses

Mollie announces its official launch in Italy, marking a significant milestone in its mission to make payments and money management effortless for every business in Europe.

Mollie enables Tap to Pay on iPhone in The Netherlands, France and Germany

Mollie customers can now use their iPhone and the Mollie iOS app to accept contactless payments without the need to purchase or manage additional hardware

Are you the next Mollie Ecommerce Manager of the Year?

Enroll yourself or your top candidate now for the Shopping Award: Mollie Ecommerce Manager of the Year!

Mollie and Hyvä announce strategic partnership, launching Hyvä Commerce

Mollie and Hyvä, a pioneer in front-end development for ecommerce, are excited to announce a strategic partnership, launching Hyvä Commerce.

Mollie announces integration with HubSpot to streamline CRM payments

Mollie announces its integration with HubSpot, which will enable businesses to initiate and track payments directly from HubSpot in seconds.

Mollie achieves triple-digit UK growth and welcomes new UK managing director

Fintech veteran Dave Smallwood’s addition and the expansion of Mollie’s UK team strengthens its market position, helping UK SMBs eliminate financial bureaucracy.

Secure more funding with Mollie Total Revenue

Access higher funding offers by including all revenue streams through Open Banking with Mollie Total Revenue. Discover how much funding you can get.

Mollie and JTL: strategic partnership for seamless e-commerce payments

JTL-Software GmbH (JTL), a leading German e-commerce solution provider, and the Dutch financial services provider Mollie are entering into a strategic partnership.

Mollie and Riverty join forces offering 30 day invoicing solution

Mollie customers can now offer end users an additional option to pay afterwards, with a payment period of up to 30 days.

Mollie Launches Invoicing Solution: Mollie Invoicing

Introducing Mollie Invoicing – our new refreshingly simple revenue collection tool. It’s a new way to create, edit, and send invoices. All from your Mollie Dashboard.

Mollie’s net revenue grew 36% in 2023

Annual results show how customer-first strategy is yielding strong returns for one of Europe’s fastest growing financial service providers.

Mollie expands through partnership with Edenred

Mollie announces a strategic partnership with Edenred to integrate diverse payment solutions, boosting merchant capabilities and enhancing customer convenience in e-commerce.

Mollie Capital launches in the UK to help firms with fast, flexible financing

Mollie Capital – a fast and flexible way for businesses to access funding – is now available in the UK.

Visit Mollie at Webwinkel Vakdagen 2024

The time has almost come: the 17th edition of the Webwinkel Vakdagen will take place on 23 and 24 March. Come and visit us at stand 33.

Mollie named an Adobe Gold Technology Partner

Mollie has been named as an Adobe Gold Technology Partner. Find out how we help Adobe Commerce businesses offer reliable, secure payments.

Biggest Black Friday week ever – with sales up 7.3% compared with 2022

Mollie data reveals record Black Friday week online spending with European consumers checking out larger basket sizes

Holiday season wins with American Express via Mollie

Not only is the holiday season is one of the most important sales events of the year for online businesses and ecommerce brands - it also attracts high-spending, loyal customers.

Mollie is now offering TWINT

Experience enhanced payment flexibility as Mollie integrates TWINT, offering seamless transactions for businesses and customers.

Mollie introduces new Supervisory & Management Board appointees

Welcoming Sarah Roberto as our new Chief Risk and Compliance Officer, Vincent Toolan as our Chief Financial Officer, and Leni Boeren to our esteemed Supervisory Board.

Mollie transitions from EU to UK Payment Institution license

Mollie takes major step in solidifying its position in the payment market of the United Kingdom.

Shopware awards Mollie Platinum Partner status

Shopware has awarded Mollie Platinum Partner status. Discover how we help Shopware customers offer the best online payment experience.

Mollie integrates with Klaviyo enabling personalised marketing automation

Tech leaders join forces to release a new and seamless integration

Magento 1 ecommerce websites and PCI compliancy

Guest post by UK agency partner Absolute Design discussing Magento 1 and PCI compliancy

The Mollie Terminal: in-person payments designed for our customers

We sat down with Mollie CEO/CTO Koen Köppen to discuss the Mollie Terminal and our move into unified commerce.

Mollie launches Terminal, strengthening its in-person payments proposition

Mollie Terminal integrates in-person and online payments for unified commerce

Mollie and Billie launch pan-European partnership

Mollie strengthens B2B product offering through Buy Now‚ Pay Later partnership with Billie.

Mollie announces change in company leadership

Former Klarna CTO Koen Köppen will drive innovation and product focus.

Shieldpay partners with financial services provider Mollie

The partnership will enable Shieldpay clients to have their payments needs fully digitised.

Mollie data reveals strong Black Friday & Cyber Week Preview

Small and medium-sized ecommerce merchants defy pessimism with strong sales increases across the peak shopping period.

5 Lessons from Megekko CEO Adri Broos to Make Better Choices as an Entrepreneur

You can learn from others' choices. Get inspired by Adri Broos' 5 lessons to make better decisions as an entrepreneur.

Mollie launches Mollie Capital to offer customers flexible financing

Mollie Capital helps businesses access fast and flexible funding to drive growth.

Mollie partners with Vonage for Jumper.ai’s European payments

We're partnering with global cloud communications leader Vonage as the strategic payment provider for their new end-to-end conversational commerce solution Jumper.ai.

Mollie named as EMEA 60 Leader by payments platform PYMNTS

The accolade recognises a company's valuation and influence among European fintech companies.

Mollie launches Technology Partner Program

Our new Technology Partner program is designed to drive growth for our SaaS and tech partners.

Mollie launches ecommerce integration with ePages

We're partnering with ePages to offer effortless payments to even more European ecommerce businesses.

Mollie and Xentral join forces to smoothen ecommerce payments and ERP processes

Mollie and Xentral now offer an integrated solution. The combined tech stack of ERP and PSP is a significant growth driver for e-commerce companies.

Mollie and Sendcloud join forces to simplify paid returns

Sendcloud and Mollie's Paid Returns allows businesses to charge customers for their return shipment automatically.

Mollie partners with Plaid to improve customer experience

Plaid's solutions will help Mollie customers access seamless onboarding and quicker bank account verification.

Koen Köppen named new Mollie CTO

Former Klarna executive Koen Köppen joins as we expand into financial services.

Philippe Daly appointed Vice President of Mollie France

Mollie is accelerating its growth in France with the appointment of Philippe Daly as Vice President.

Mollie launches in3 buy now pay later payments

Mollie customers operating in the Netherlands can now offer in3 as a payment method.

Mollie named a BigCommerce preferred technology partner

Discover more about how our flexible online payments are driving growth for BigCommerce customers.

Mollie teams up with Recharge to offer best-in-class subscription solution

Our new subscription management and recurring payments integration is here.

Mollie Payments for WooCommerce arrives in the UK

Discover how our long-term partnership with WooCommerce is accelerating growth for businesses throughout Europe.

Mollie powers Mazda with simplified payments

Discover how Mollie Connect for Platforms is powering payments for Mazda's new marketplace platform

Mollie launches Connect for Platforms

An effortless payment solution built for platform businesses to quickly integrate‚ accept and scale their online payments.

Mollie appoints ex-PayPal Annett Polaszewski-Plath as managing director DACH

Polaszewski-Plath is responsible for the payment service provider's growth in Germany‚ Austria‚ and Switzerland.

Mollie and Chargebee: effortless subscriptions and payments

Mollie and Chargebee have teamed up to offer a subscription management and billing tool that offers exceptional payments‚ service and support.

Mollie’s mission: why we want to be the world's most-loved PSP

Our mission is to simplify financial services so that all businesses can grow. For us‚ it's more than just words; it's the fuel driving everything that we do.

Mollie announces fintech Centre of Excellence in Maastricht Netherlands

New site to boost Maastricht economy‚ targeting over 200 hires across operations‚ software engineering‚ product design legal‚ compliance‚ commercial and HR in the next 3-5 years.

Customer Stories: Praxisdienst

"Mollie is much more reliable and faster in change management‚” — Michael Heine CEO at Praxisdienst.

Mollie raises 800 million USD in Blackstone Growth–led Series C funding round

The investment will help accelerate Mollie's scaling‚ global expansion and technology development.

Rogier Schoute has been appointed as Mollie’s Chief Product Officer

Introducing Mollie's new Chief Product Officer Rogier Schoute

Shane Happach has been appointed as Mollie’s new CEO

We are pleased to announce that Shane Happach has been appointed as Mollie's new CEO.

Mollie: A Secure Intermediary Between Your Bank Account and an Online Store

Explore Mollie's secure online transactions, ensuring your payment safety with webshops.

Mollie raises 90 million Euro in TCV-led Series B funding

Brings total raised to 115 million Euro‚ will help drive Mollie's international expansion and new product development.

Invoices Settled Swifter with Payment Links

Boost invoice payments effortlessly with secure payment links. Quick, easy, and adaptable, enhancing customer payment convenience.

Mollie and Shopify: Growing together in Europe

We've just extended our partnership with Shopify! Now‚ merchants throughout the whole of Europe can use all our major payment methods in an easy integration.

Mollie raises €25 million in first-ever funding round

Fundraising from long-term strategic investors to support the company's rapid expansion and simplify the lives of online small and medium-sized businesses across Europe.

Mollie launches collaboration with online accounting platform Yuki

Keeping track of your accounting has just become even easier‚ thanks to the integration of Yuki and Mollie.

Mollie introduces plugin for OXID

The payment service provider Mollie has released its latest plugin for OXID eShop.

Plugin update: Recurring payments with Mollie and WooCommerce Subscriptions

Enhance your WooCommerce store with Mollie's plugin update, now supporting hassle-free recurring payments for subscriptions and more.

Mollie enters the Czech payments market, offers Czech localization and support

Mollie expands into Central Europe expands to support local businesses as the company reduces financial bureaucracy across Europe.

Mollie launches Tap: its smart payment terminal for seamless in-person payments

Mollie Tap: Smart, fast, affordable terminal for seamless in-person payments. Unify online & offline sales. Easy, affordable, ready in 30 secs.

Mollie and Peakz Padel join forces to drive impact on and off the court

Mollie & Peakz Padel reveal Mollie Dome

Mollie grows by 30% in 2024

2024 Financial Results

Mollie launches payment solutions in Portugal for the growing ecommerce market

Lisbon tech hub expands to support local businesses as Mollie reduces financial bureaucracy across Europe.

Qonto & Mollie announce two-way collaboration to empower European businesses

Qonto integrates Mollie’s embedded payments solution to enable its customers to easily accept payments online.

Mollie expands into Sweden

Mollie chooses Sweden for Nordic expansion.

Mollie enables Tap to Pay on iPhone in Austria, Italy and the United Kingdom

Mollie customers in Austria, Italy and UK can now use their iPhone and the Mollie iOS app to accept contactless payments without the need to purchase or manage additional hardware

Mollie and Alma join forces to offer a new growth driver for merchants

Mollie is delighted to announce its partnership with Alma to provide payment solutions in 3 or 4 instalments in France and Belgium.

Mollie and PayPal join forces to enhance marketplace payments in Europe

Mollie is excited to announce a strategic partnership with PayPal, aimed at delivering secure and easy payment solutions for marketplace platforms across Europe.

Mollie expands into Italy with local payment solutions for businesses

Mollie announces its official launch in Italy, marking a significant milestone in its mission to make payments and money management effortless for every business in Europe.

Mollie enables Tap to Pay on iPhone in The Netherlands, France and Germany

Mollie customers can now use their iPhone and the Mollie iOS app to accept contactless payments without the need to purchase or manage additional hardware

Are you the next Mollie Ecommerce Manager of the Year?

Enroll yourself or your top candidate now for the Shopping Award: Mollie Ecommerce Manager of the Year!

Mollie and Hyvä announce strategic partnership, launching Hyvä Commerce

Mollie and Hyvä, a pioneer in front-end development for ecommerce, are excited to announce a strategic partnership, launching Hyvä Commerce.

Mollie announces integration with HubSpot to streamline CRM payments

Mollie announces its integration with HubSpot, which will enable businesses to initiate and track payments directly from HubSpot in seconds.

Mollie achieves triple-digit UK growth and welcomes new UK managing director

Fintech veteran Dave Smallwood’s addition and the expansion of Mollie’s UK team strengthens its market position, helping UK SMBs eliminate financial bureaucracy.

Secure more funding with Mollie Total Revenue

Access higher funding offers by including all revenue streams through Open Banking with Mollie Total Revenue. Discover how much funding you can get.

Mollie and JTL: strategic partnership for seamless e-commerce payments

JTL-Software GmbH (JTL), a leading German e-commerce solution provider, and the Dutch financial services provider Mollie are entering into a strategic partnership.

Mollie and Riverty join forces offering 30 day invoicing solution

Mollie customers can now offer end users an additional option to pay afterwards, with a payment period of up to 30 days.

Mollie Launches Invoicing Solution: Mollie Invoicing

Introducing Mollie Invoicing – our new refreshingly simple revenue collection tool. It’s a new way to create, edit, and send invoices. All from your Mollie Dashboard.

Mollie’s net revenue grew 36% in 2023

Annual results show how customer-first strategy is yielding strong returns for one of Europe’s fastest growing financial service providers.

Mollie expands through partnership with Edenred

Mollie announces a strategic partnership with Edenred to integrate diverse payment solutions, boosting merchant capabilities and enhancing customer convenience in e-commerce.

Mollie Capital launches in the UK to help firms with fast, flexible financing

Mollie Capital – a fast and flexible way for businesses to access funding – is now available in the UK.

Visit Mollie at Webwinkel Vakdagen 2024

The time has almost come: the 17th edition of the Webwinkel Vakdagen will take place on 23 and 24 March. Come and visit us at stand 33.

Mollie named an Adobe Gold Technology Partner

Mollie has been named as an Adobe Gold Technology Partner. Find out how we help Adobe Commerce businesses offer reliable, secure payments.

Biggest Black Friday week ever – with sales up 7.3% compared with 2022

Mollie data reveals record Black Friday week online spending with European consumers checking out larger basket sizes

Holiday season wins with American Express via Mollie

Not only is the holiday season is one of the most important sales events of the year for online businesses and ecommerce brands - it also attracts high-spending, loyal customers.

Mollie is now offering TWINT

Experience enhanced payment flexibility as Mollie integrates TWINT, offering seamless transactions for businesses and customers.

Mollie introduces new Supervisory & Management Board appointees

Welcoming Sarah Roberto as our new Chief Risk and Compliance Officer, Vincent Toolan as our Chief Financial Officer, and Leni Boeren to our esteemed Supervisory Board.

Mollie transitions from EU to UK Payment Institution license

Mollie takes major step in solidifying its position in the payment market of the United Kingdom.

Shopware awards Mollie Platinum Partner status

Shopware has awarded Mollie Platinum Partner status. Discover how we help Shopware customers offer the best online payment experience.

Mollie integrates with Klaviyo enabling personalised marketing automation

Tech leaders join forces to release a new and seamless integration

Magento 1 ecommerce websites and PCI compliancy

Guest post by UK agency partner Absolute Design discussing Magento 1 and PCI compliancy

The Mollie Terminal: in-person payments designed for our customers

We sat down with Mollie CEO/CTO Koen Köppen to discuss the Mollie Terminal and our move into unified commerce.

Mollie launches Terminal, strengthening its in-person payments proposition

Mollie Terminal integrates in-person and online payments for unified commerce

Mollie and Billie launch pan-European partnership

Mollie strengthens B2B product offering through Buy Now‚ Pay Later partnership with Billie.

Mollie announces change in company leadership

Former Klarna CTO Koen Köppen will drive innovation and product focus.

Shieldpay partners with financial services provider Mollie

The partnership will enable Shieldpay clients to have their payments needs fully digitised.

Mollie data reveals strong Black Friday & Cyber Week Preview

Small and medium-sized ecommerce merchants defy pessimism with strong sales increases across the peak shopping period.

5 Lessons from Megekko CEO Adri Broos to Make Better Choices as an Entrepreneur

You can learn from others' choices. Get inspired by Adri Broos' 5 lessons to make better decisions as an entrepreneur.

Mollie launches Mollie Capital to offer customers flexible financing

Mollie Capital helps businesses access fast and flexible funding to drive growth.

Mollie partners with Vonage for Jumper.ai’s European payments

We're partnering with global cloud communications leader Vonage as the strategic payment provider for their new end-to-end conversational commerce solution Jumper.ai.

Mollie named as EMEA 60 Leader by payments platform PYMNTS

The accolade recognises a company's valuation and influence among European fintech companies.

Mollie launches Technology Partner Program

Our new Technology Partner program is designed to drive growth for our SaaS and tech partners.

Mollie launches ecommerce integration with ePages

We're partnering with ePages to offer effortless payments to even more European ecommerce businesses.

Mollie and Xentral join forces to smoothen ecommerce payments and ERP processes

Mollie and Xentral now offer an integrated solution. The combined tech stack of ERP and PSP is a significant growth driver for e-commerce companies.

Mollie and Sendcloud join forces to simplify paid returns

Sendcloud and Mollie's Paid Returns allows businesses to charge customers for their return shipment automatically.

Mollie partners with Plaid to improve customer experience

Plaid's solutions will help Mollie customers access seamless onboarding and quicker bank account verification.

Koen Köppen named new Mollie CTO

Former Klarna executive Koen Köppen joins as we expand into financial services.

Philippe Daly appointed Vice President of Mollie France

Mollie is accelerating its growth in France with the appointment of Philippe Daly as Vice President.

Mollie launches in3 buy now pay later payments

Mollie customers operating in the Netherlands can now offer in3 as a payment method.

Mollie named a BigCommerce preferred technology partner

Discover more about how our flexible online payments are driving growth for BigCommerce customers.

Mollie teams up with Recharge to offer best-in-class subscription solution

Our new subscription management and recurring payments integration is here.

Mollie Payments for WooCommerce arrives in the UK

Discover how our long-term partnership with WooCommerce is accelerating growth for businesses throughout Europe.

Mollie powers Mazda with simplified payments

Discover how Mollie Connect for Platforms is powering payments for Mazda's new marketplace platform

Mollie launches Connect for Platforms

An effortless payment solution built for platform businesses to quickly integrate‚ accept and scale their online payments.

Mollie appoints ex-PayPal Annett Polaszewski-Plath as managing director DACH

Polaszewski-Plath is responsible for the payment service provider's growth in Germany‚ Austria‚ and Switzerland.

Mollie and Chargebee: effortless subscriptions and payments

Mollie and Chargebee have teamed up to offer a subscription management and billing tool that offers exceptional payments‚ service and support.

Mollie’s mission: why we want to be the world's most-loved PSP

Our mission is to simplify financial services so that all businesses can grow. For us‚ it's more than just words; it's the fuel driving everything that we do.

Mollie announces fintech Centre of Excellence in Maastricht Netherlands

New site to boost Maastricht economy‚ targeting over 200 hires across operations‚ software engineering‚ product design legal‚ compliance‚ commercial and HR in the next 3-5 years.

Customer Stories: Praxisdienst

"Mollie is much more reliable and faster in change management‚” — Michael Heine CEO at Praxisdienst.

Mollie raises 800 million USD in Blackstone Growth–led Series C funding round

The investment will help accelerate Mollie's scaling‚ global expansion and technology development.

Rogier Schoute has been appointed as Mollie’s Chief Product Officer

Introducing Mollie's new Chief Product Officer Rogier Schoute

Shane Happach has been appointed as Mollie’s new CEO

We are pleased to announce that Shane Happach has been appointed as Mollie's new CEO.

Mollie: A Secure Intermediary Between Your Bank Account and an Online Store

Explore Mollie's secure online transactions, ensuring your payment safety with webshops.

Mollie raises 90 million Euro in TCV-led Series B funding

Brings total raised to 115 million Euro‚ will help drive Mollie's international expansion and new product development.

Invoices Settled Swifter with Payment Links

Boost invoice payments effortlessly with secure payment links. Quick, easy, and adaptable, enhancing customer payment convenience.

Mollie and Shopify: Growing together in Europe

We've just extended our partnership with Shopify! Now‚ merchants throughout the whole of Europe can use all our major payment methods in an easy integration.

Mollie raises €25 million in first-ever funding round

Fundraising from long-term strategic investors to support the company's rapid expansion and simplify the lives of online small and medium-sized businesses across Europe.

Mollie launches collaboration with online accounting platform Yuki

Keeping track of your accounting has just become even easier‚ thanks to the integration of Yuki and Mollie.

Mollie introduces plugin for OXID

The payment service provider Mollie has released its latest plugin for OXID eShop.

Plugin update: Recurring payments with Mollie and WooCommerce Subscriptions

Enhance your WooCommerce store with Mollie's plugin update, now supporting hassle-free recurring payments for subscriptions and more.