User-friendly, secure, trusted, flexible. Payment cards are popular with shoppers and offer businesses numerous benefits: increased reach, flexibility, and conversion. You can also access in-depth insights on card transactions and fraud prevention tools.

Convert shoppers in new markets

Consumers globally trust their payment cards for online and physical purchases. By accepting card payments, you can tap into this trust, attracting new customers and reducing cart abandonment.

Do you have plans to expand abroad? Cards make reaching consumers in a new market easier and can boost your sales. They also make currency conversion easier.

Unlock new payment methods

As well as online payments, cards allow you to receive recurring, digital wallet, and in-person payments.

Recurring payments are a simple and convenient way for customers to pay for services or subscriptions. After an initial payment, usually made with a credit card, the customer permits you to collect the same amount at regular intervals automatically.

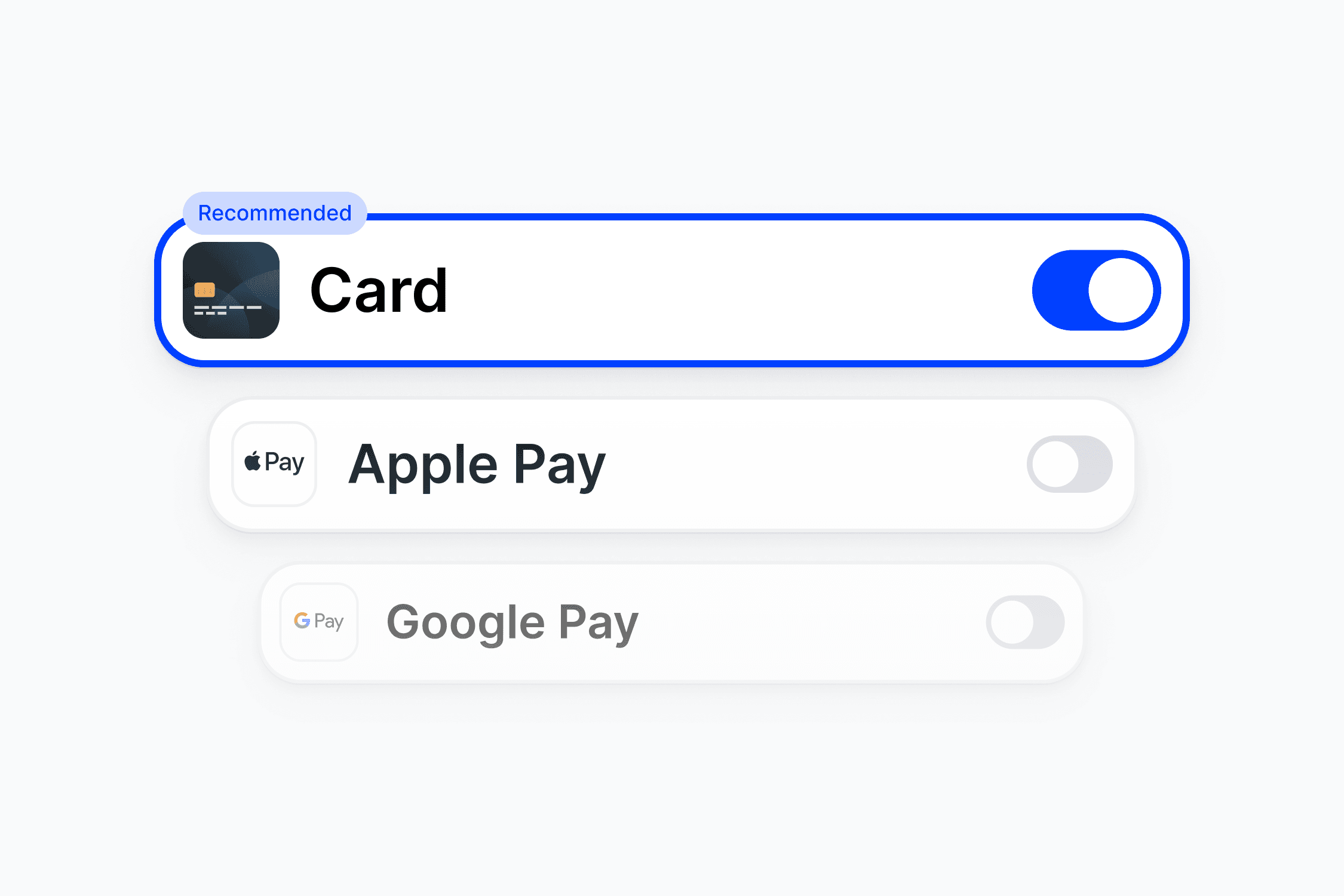

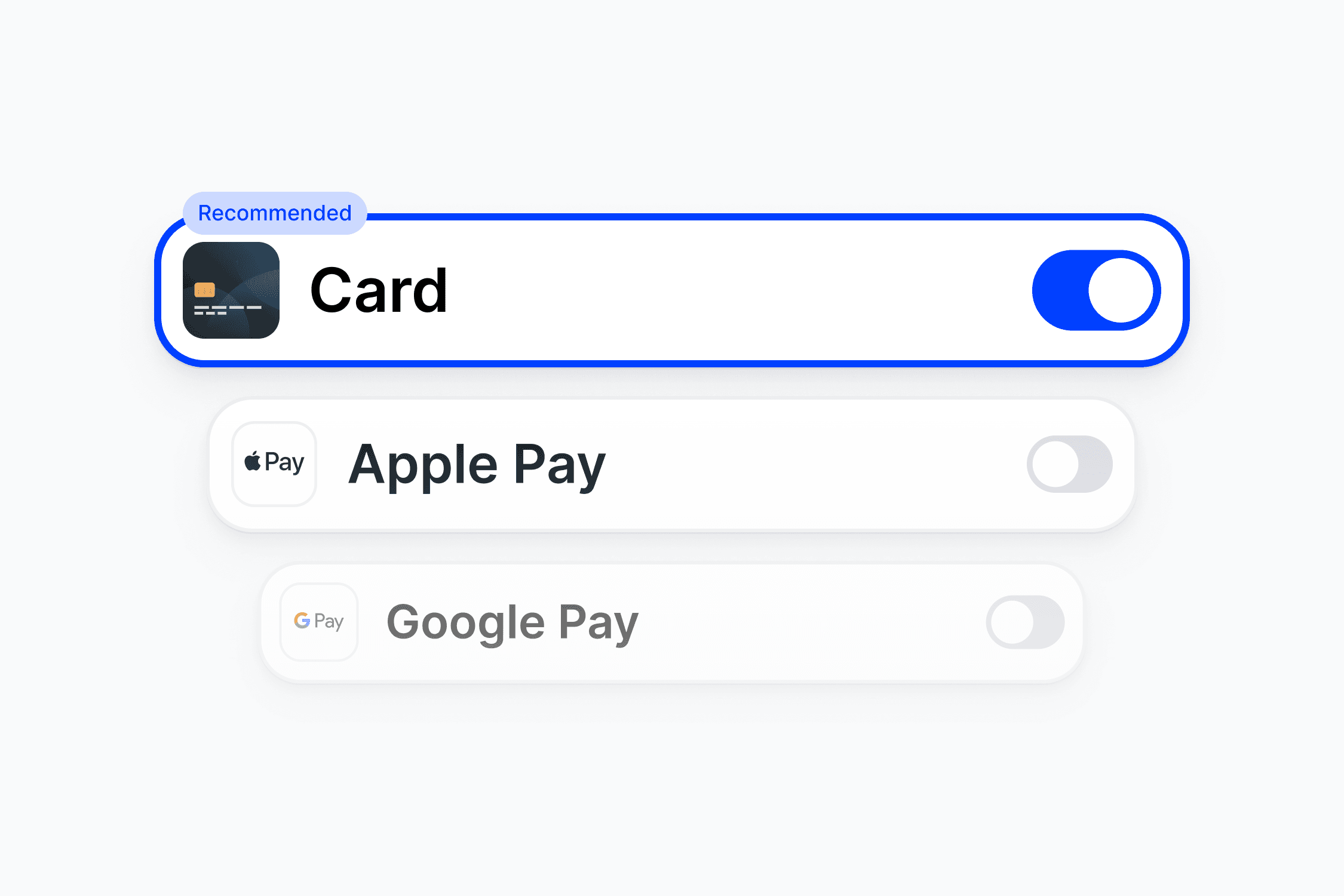

Digital wallets such as Google Pay and Apple Pay are usually linked to a debit or credit card. When a customer pays with Google Pay, the wallet uses the stored card data to process the payment. You can only process these transactions if your webshop supports card payments. To receive payments with digital wallets, you must first activate credit cards as a payment method in your Mollie Dashboard.

In-person payments: by activating card payments in your Mollie Dashboard, you also get access to various solutions for in-person payments, such as Mollie Terminal, Tap to Pay, QR code payments, and payment links. Cards are an excellent choice for omnichannel businesses.

Improved security and risk management

Cards have a reputation for being more susceptible to fraud than other payment methods, as card data can be intercepted or misused in various ways.

However, much progress has been made on security measures to mitigate the risks. The most important are the revised Payment Services Directive (PSD2), Strong Customer Authentication (SCA), and 3D Secure 2.0 (3DS2).

With Mollie, your business automatically complies with the rules set by major card networks like Visa and Mastercard – as well as the EU. This ensures that your customers' card details and personal data are always fully secure and stored safely.

We also offer advanced tools to combat fraud while optimising payment acceptance.

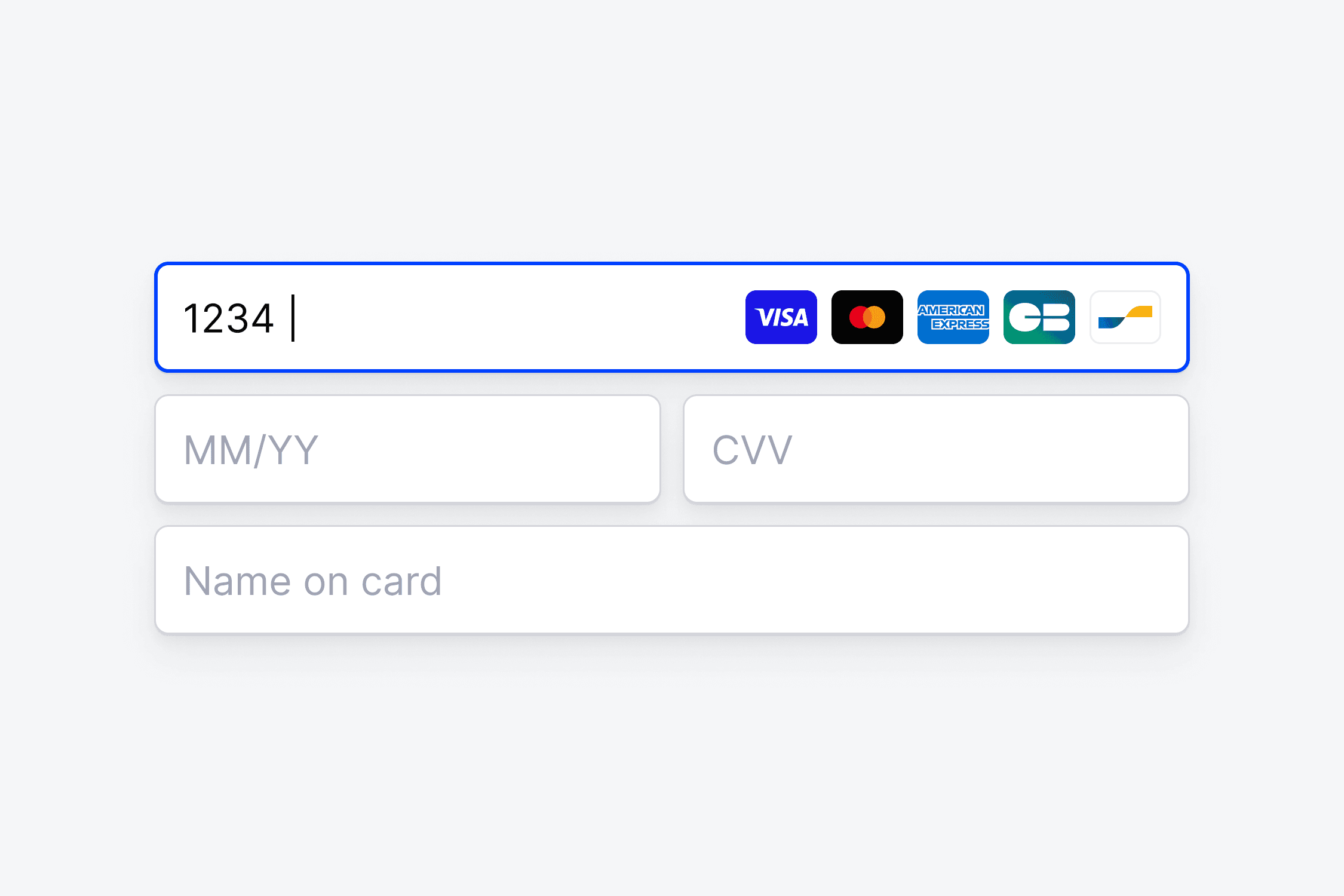

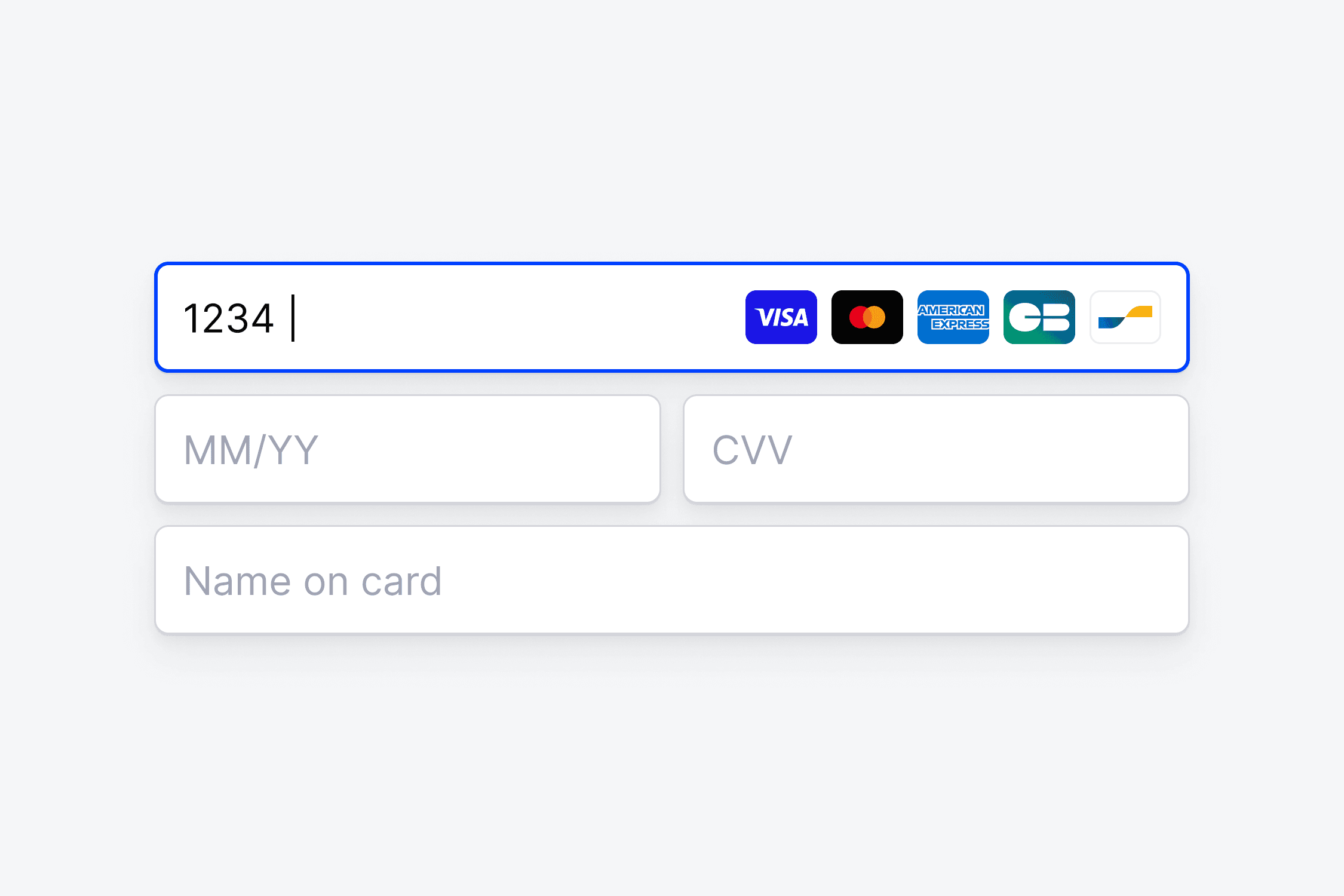

Personalised payment experience: Create a payment experience that suits your business by choosing from various optimised and secure user interfaces. Cards are supported by all Mollie interfaces: Mollie Checkout, Mollie Components, and Mollie Terminal.

Dynamic 3DS screening: Our dynamic 3D Secure solution ensures payment security and compliance with SCA rules while improving customer experience by eliminating friction and unnecessary checkout steps. Want to know more about 3DS? Go to our 3D Secure and 3D Secure 2 guide.

Customised fraud prevention settings: Acceptance & Risk is our solution to optimise card payment performance by minimising fraud and maximising card acceptance. You can customise fraud prevention measures according to your business needs and risk profile.

In-depth card transaction insights

The Mollie Dashboard provides a clear overview of all your transactions, including card payments.

Using our detailed reports, you can analyse your card transactions and discover new information about your customers, such as where they are based. That helps you to spot trends, improve the customer experience, and optimise sales.