Now that you have uncovered the key reasons for cart abandonment, let’s explore how to improve the buying experience and boost ecommerce revenues with these five checkout process best practices (accompanied by real-life examples from other businesses).

Simplify the checkout process

Once a customer decides to purchase, the website’s goal is to ensure the order is completed as quickly and easily as possible. The key is to make the checkout process simple, frictionless and intuitive.

One-click checkout

For users who repeatedly order from an online store, re-entering their personal details each time is frustrating and time-consuming.

The solution is to enable one-click payments during the ordering process, where payment data from previous orders is encrypted and stored as tokens. This way, customers can pay even faster when placing a new order.

Offer the option to order ‘as a guest’.

While information in a customer database is valuable for subsequent marketing activities, there should be no obligation for customers to register. For many customers, the effort required to create an account with a company they don’t know or have no relationship with can lead to order abandonment.

Additionally, many users prefer ordering something before creating an account. So while they may purchase ‘as a guest’ the first time, if and when they return, they could be far more likely to register to streamline future orders.

Smart form filling

During checkout, you must collect key data, including the order recipient's name, delivery and billing addresses, and contact details. To avoid making customer fields tedious and time-consuming, merchants should request only the data essential to successful order processing.

If you want to collect additional information, it’s advisable to mark the fields as ‘optional’. Furthermore, live validation also improves the user experience when entering data. For instance, an invalid postal code can be marked as faulty immediately.

Mollie Checkout can help you adopt these elements by enabling you to easily design a checkout page with single-click payments, best-in-class security, localised language, and payment methods.

Customise your checkout design

A customised checkout should feel like the secure extension of your brand. When the checkout matches your store’s look and feel, you eliminate friction that can arise when a shopper is unexpectedly redirected to a 3rd-party payment page and loses trust due to a different page design.

With a platform like Mollie, customisation goes beyond just adding a logo. We make sure you can tailor the whole experience:

Match your UI: Align fonts, colours, and button styles to maintain brand consistency.

Bridge the gap with QR codes: Seamlessly move customers from desktop browsing to mobile payments (such as Apple Pay or Bancontact) with on-screen QR codes.

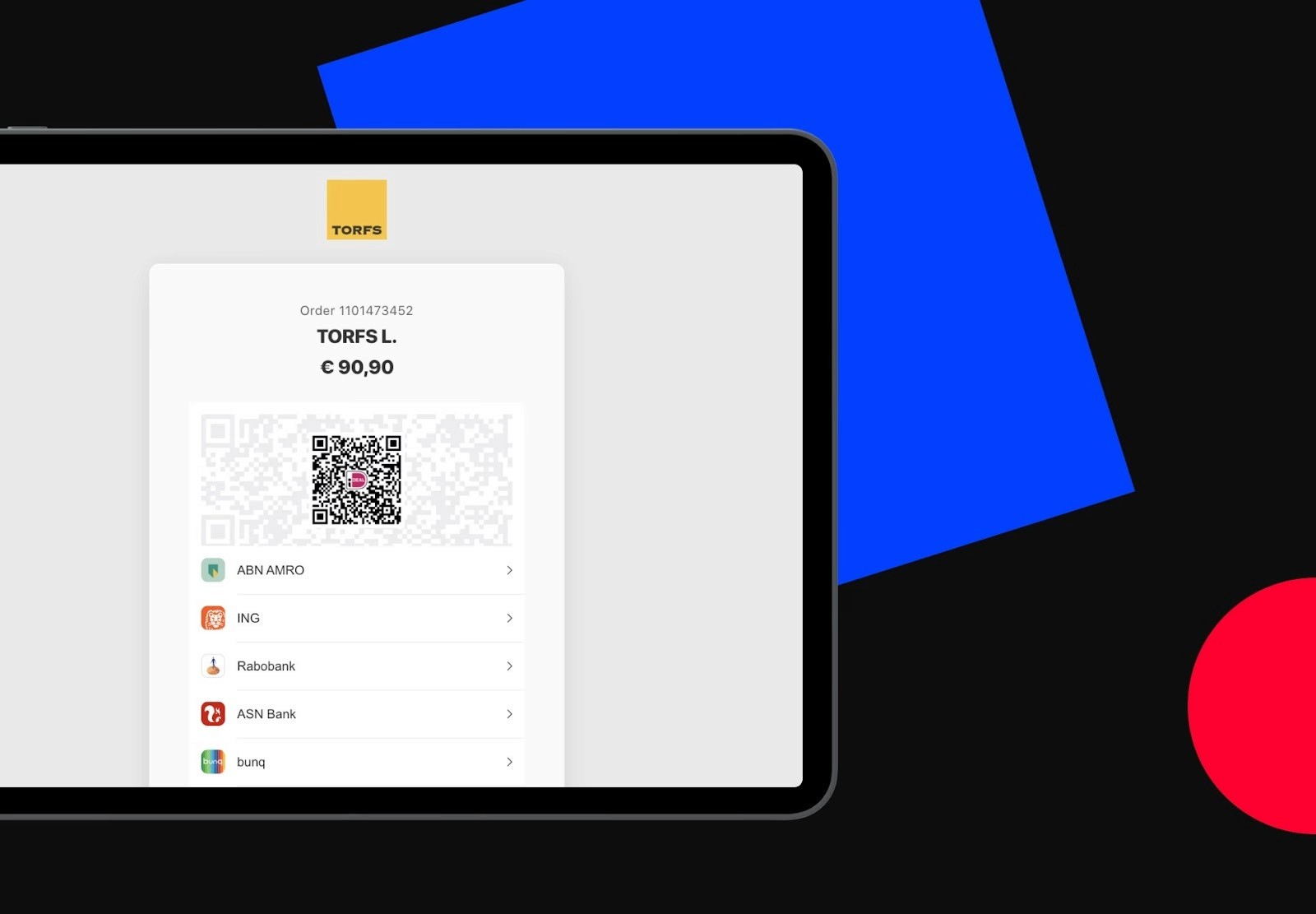

Torfs drives revenue with a customised checkout design

Belgian shoe retailer Torfs is an example of how a checkout optimised for conversion can boost sales. They display a Bancontact QR code in the checkout so shoppers can pay immediately.

Torf displaying a Bancontact QR code at the checkout window

Offer a range of different payment methods

Every consumer has a favourite payment method. Some prefer credit cards or digital wallets, while others prefer to pay with trusted local methods such as iDEAL or Bancontact. Ecommerce companies need to get their payment method mix just right – especially when selling internationally.

Leading payment service providers offer practical integrations for this purpose, allowing multiple online payment methods to be integrated into the shop through a single plugin. This not only reduces costs but also optimises the customer journey, leading to higher conversion rates.

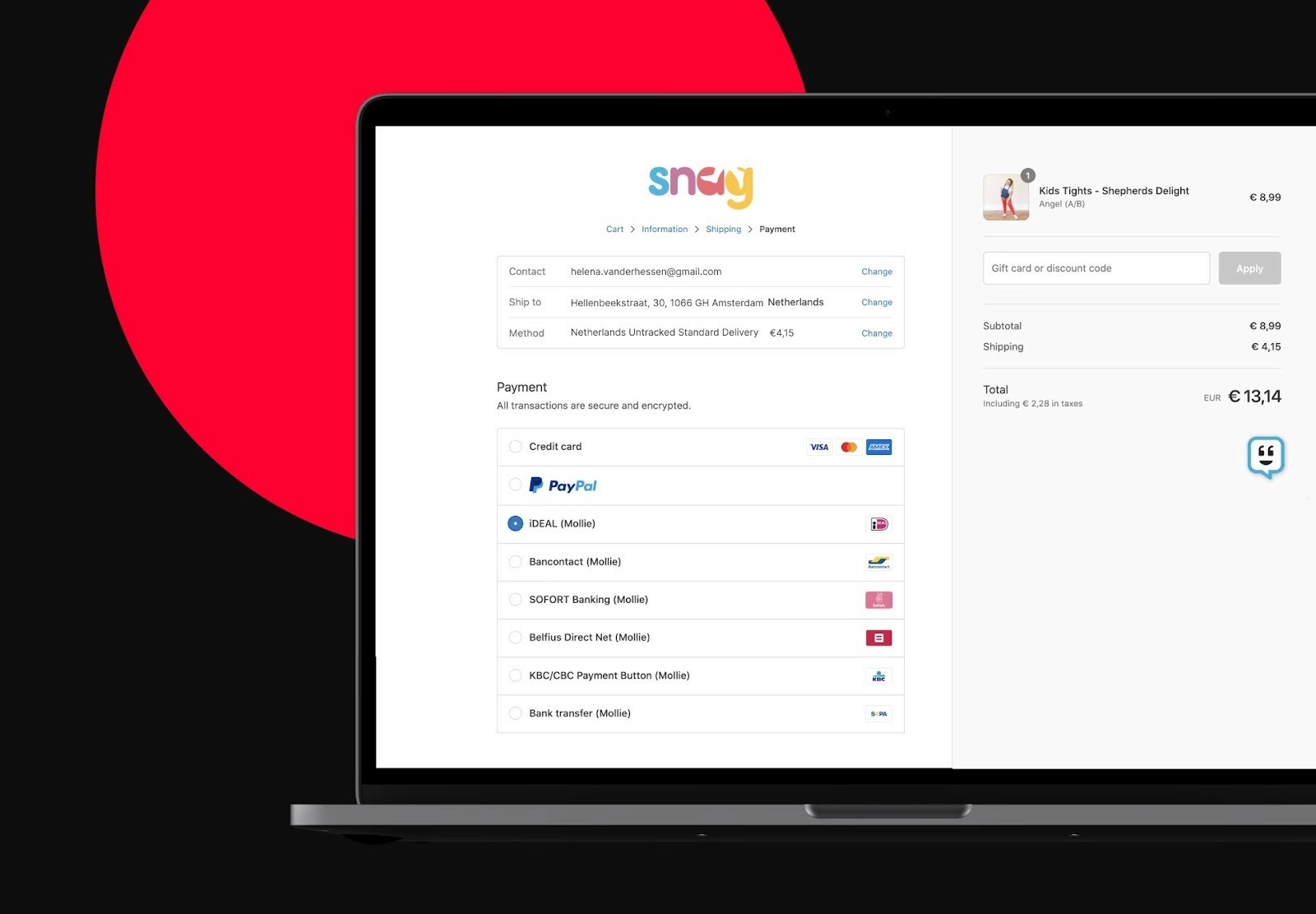

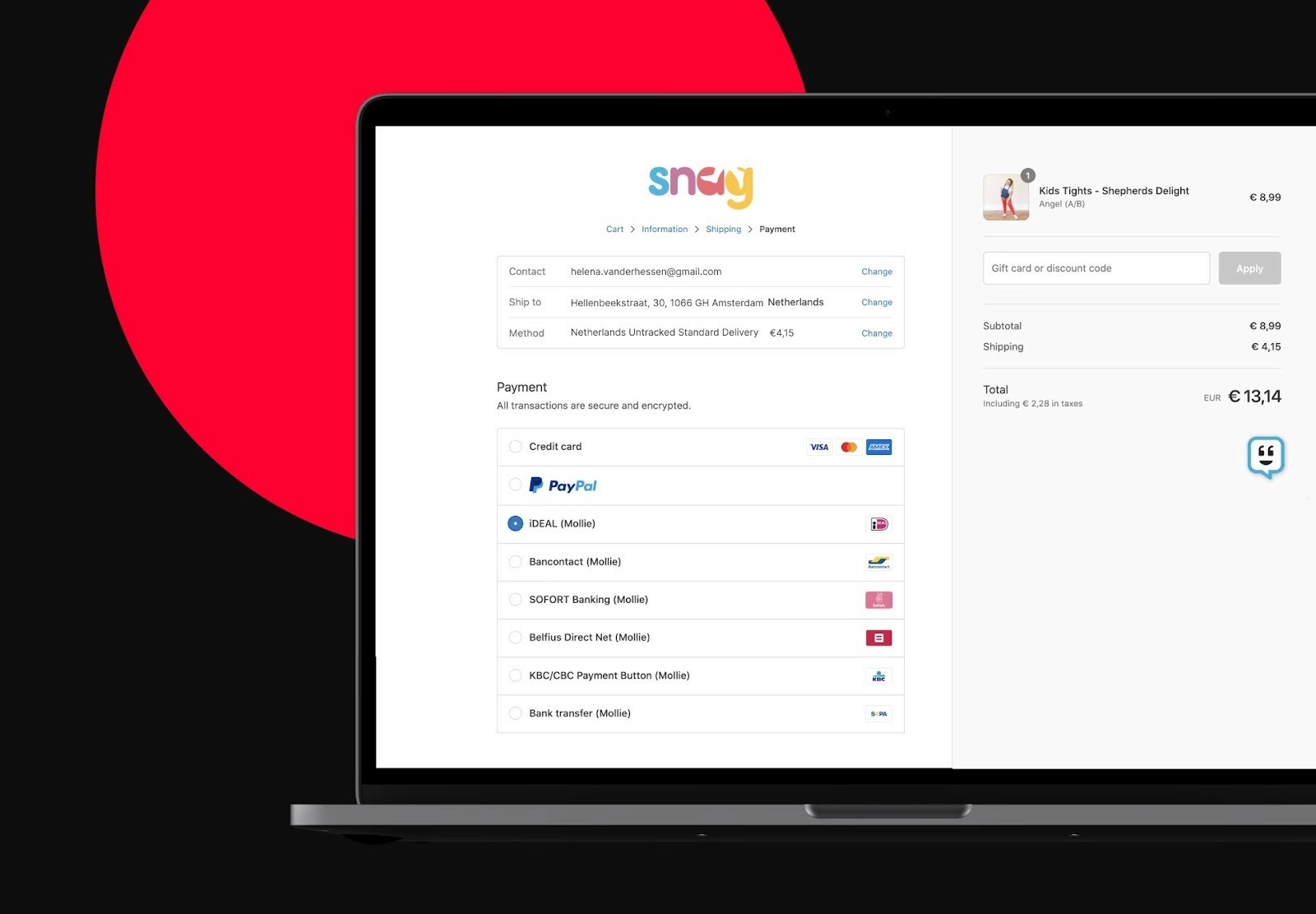

Increasing revenue with localisation at Snag

A good example of this is the sustainable fashion brand Snag, which initially focused solely on the UK market but now generates one-third of its sales in the EU. They’ve invested heavily in refining their customer experience, as reflected in their impressive Trustpilot score of 4.8.

The process Snag used to ensure its success in expanding into new markets warrants closer examination. Simply introducing local languages at checkout doubled their conversion rate, from 4% to 8%. They then added local payment methods, which raised the conversion rate to 10% and significantly increased revenue.

Snag offers localised payment methods and languages to increase conversion

Once you have localised payment methods, currencies, and languages, you can take it one step further by showing only the relevant payment methods for each market, helping to increase conversion and checkout speed.

Empower users with transparency

When designing a website checkout layout, make sure it clearly displays all essential information to the customer. An appealing layout also supports the intuitive understanding of the checkout process.

A lack of transparency can lead to abandoned carts and lost sales, especially for businesses selling high-ticket items, apparel, or products where sizing and fit are essential.

Below are some ways to increase transparency for your customers during checkout.

Provide transparent return policies

Uncertainty about meeting product expectations and a lack of a clear return policy at checkout can deter online shoppers. Retailers should craft a comprehensive return policy that is easy to find and understand, outlines return timeframes, refund processing, and conditions.

Offering hassle-free return shipping reassures customers and typically increases conversions by providing a safety net, especially in high-return categories such as fashion, electronics, and furniture.

Offer various shipping options

As with payment methods, customers have different preferences for shipping service providers. Therefore, it is worthwhile for shop owners to offer multiple parcel services. This way, customers can choose to have their package delivered by DHL, UPS, Hermes, or DPD, for example.

Establish trust with badges and customer reviews

Trust badges convey credibility and assure customers that shopping in the online store is secure. If potential customers lack confidence in a store's credibility, they are more likely to order from a trusted competitor.

Retailers should strive to obtain the following badges in their online store:

Trusted Shops

TÜV Seal

Merchant Association’s Buyer’s Seal

EHI Seal

Secure browser connection (SSL/HTTPS)

To reassure customers, businesses should prominently display trust signals throughout the checkout process. This can include:

SSL certificates confirm encrypted transactions.

Payment security logos (e.g., Visa Secure, PayPal Verified).

Customer service guarantees (easy returns, money-back policies).

Verified customer reviews or testimonials.

Optimise for all devices

Many mobile shoppers abandon their carts due to frustrating checkout experiences, including slow loading times, difficult-to-tap buttons, and multiple form fields.

To improve mobile checkout conversion, simplifying the process is the key. This can be done by adopting a one-page checkout, condensing forms to essential details, or using smart autofill.

Designing for touch with large buttons and mobile-optimised keyboards is also important to ensure easy interaction. Moreover, retailers can reduce load times by optimising images, reducing code, and implementing Accelerated Mobile Pages (AMP).

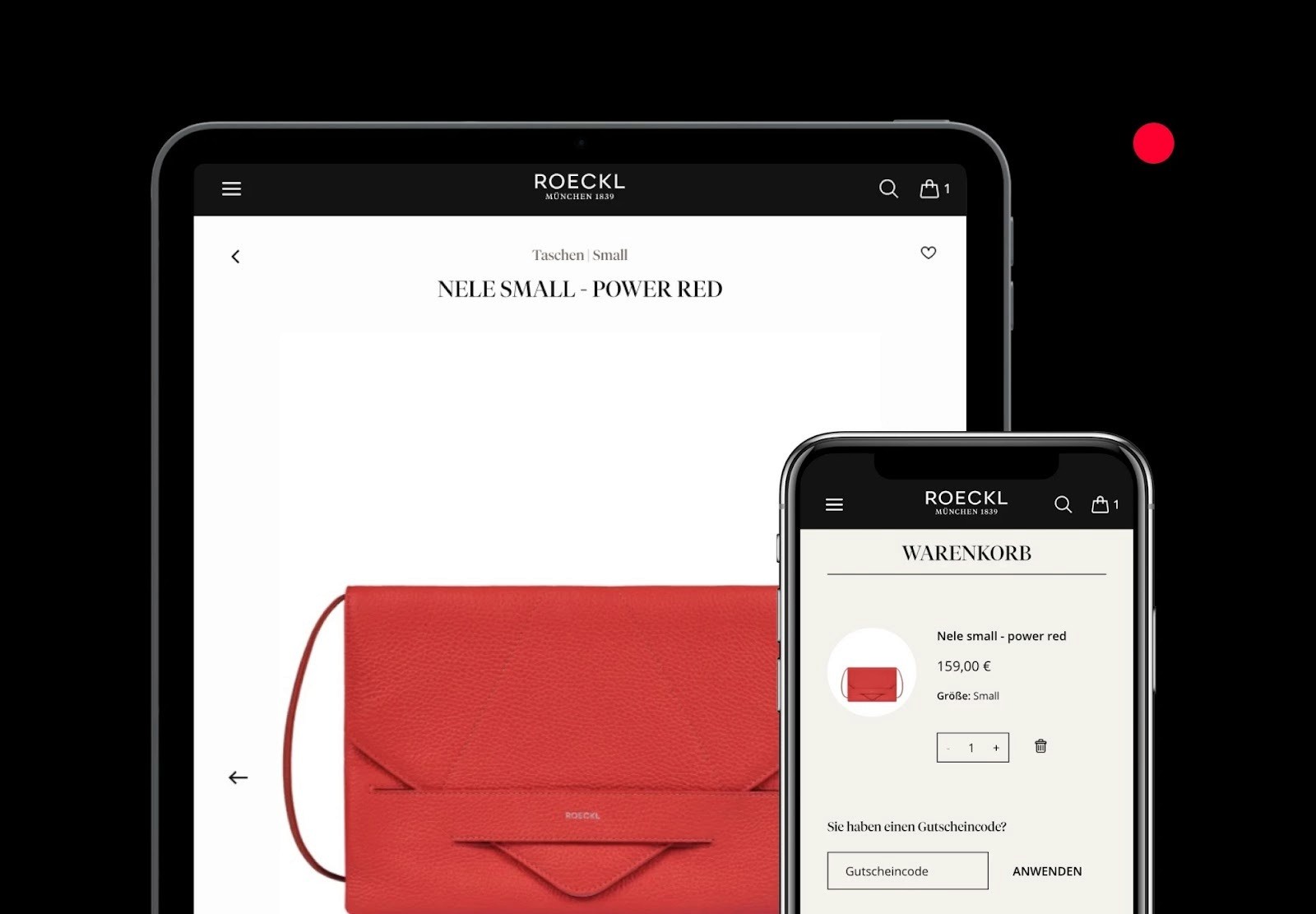

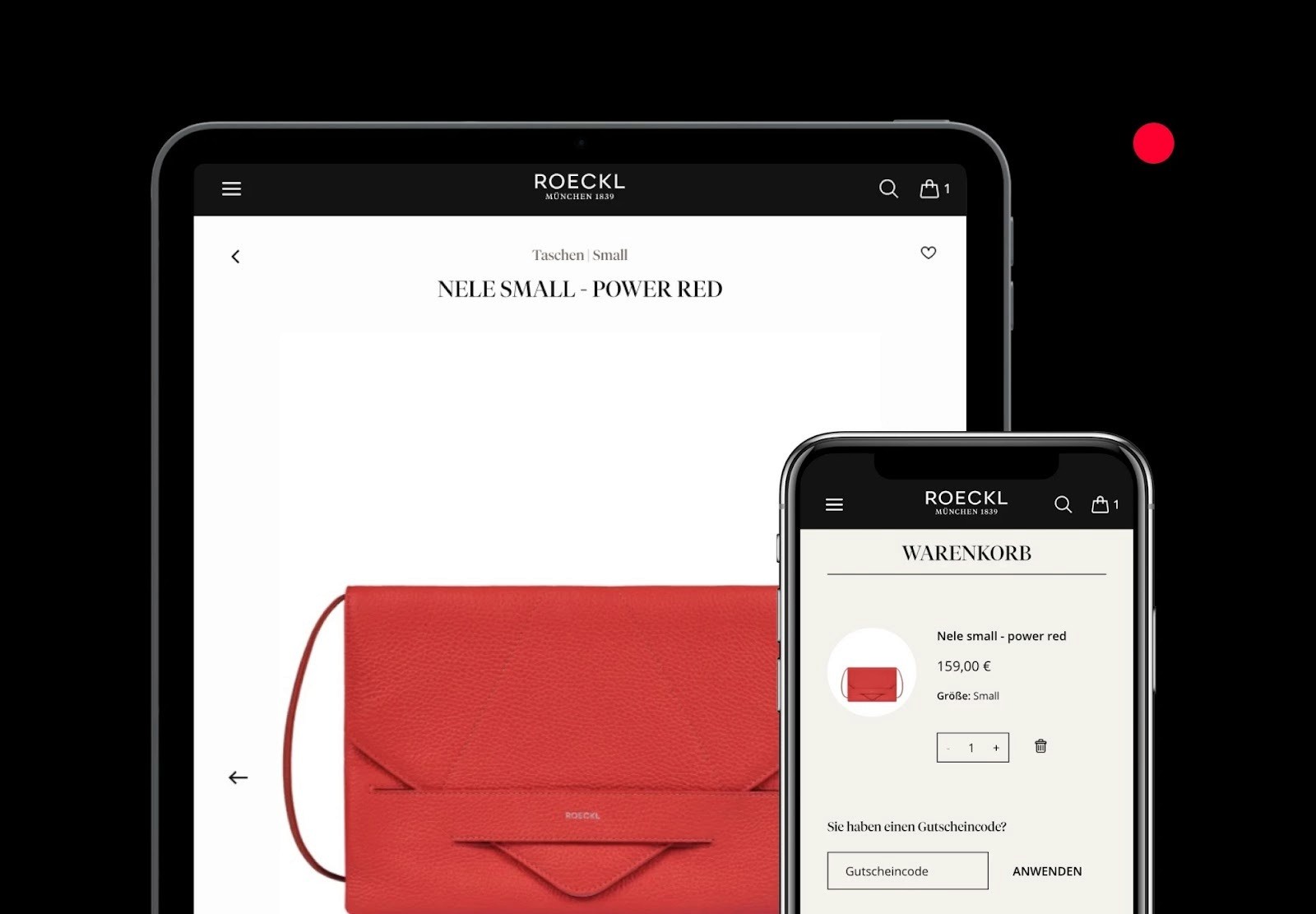

Roeckl – using a payment service provider to grow and modernise

Luxury accessories brand Roeckl, a German firm established in 1839, has traditionally relied on point-of-sale channels to sell its products. But as their online business became top of mind, they realised they needed to focus on mobile payments and sought a partner to support it.

Roeckl seamless mobile checkout

Using Mollie, they began offering the most relevant payment methods for the German market, such as PayPal, Klarna, and credit cards, to deliver a seamless checkout and payment experience.

You can read the full story here.

Issue ongoing internal reviews

Diane Albouy, Principal Product Manager at Mollie, identified a common, easily fixable mistake on checkout pages: a lack of regular internal review.

She advises ecommerce heads to review their checkout process daily to identify and resolve issues such as non-functional tabs, poor font selection, or greyed-out buttons.

It can also be useful to ask friends and family to try and buy something on the site. Anywhere they get stuck should become a priority for reducing friction.

Leverage the power of AI

The launch of agentic commerce in the US and, soon, in Europe promises to transform how people buy, from product discovery to conversations with AI assistants.

You can leverage AI in many ways to optimise the checkout process, making it faster, more innovative, and more personalised.

Personalise the buying experience: AI can analyse customer data, such as preferences and order history, to recommend suitable products and special deals.

Simplifying the checkout process: With tokenised payments, customers never have to re-enter payment or shipping details, making the purchase lightning-fast.

Offer smart payments: AI recommends the most suitable payment methods for your customers based on their preferences.

Reduce friction during checkout: AI can streamline transactions by enabling autofill, predictive text, and real-time error detection, making the buying process hassle-free for customers.

Want more practical, strategic information about agentic commerce? You can check out our latest guide – “Agentic commerce: Your questions answered.”